The Labor Department’s jobs report was released this morning and it certainly paints a rosier picture than ADP’s grim analysis from earlier this week (re: only 67,000 private sector jobs added in November—

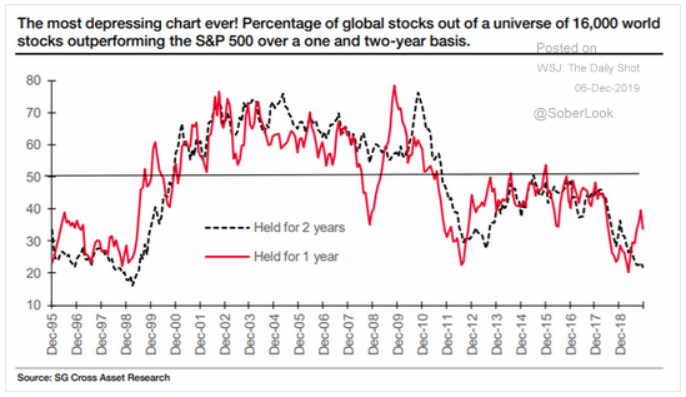

less than half of what was expected). With the Fed’s recent adoption of the Sahm rule, we know how indicative employment numbers can be of oncoming recessions, but analysis can get tricky when you’re looking at conflicting reports. Meanwhile, the previously resilient services sector is starting to show some wear; could that lend credence to some growing labor market anxieties? And we’ve spoken a lot about large-cap dominance this year, but a look at the S&P 500 relative to 16,000 global stocks is making us wonder if we might be in the midst of a unique cycle with some longevity left in it. And what could the same index indicate about the struggling manufacturing sector? View the charts to find out!

1. A big miss. Don’t forget the Sahm rule…

Source: WSJ Daily Shot, from 12/5/19

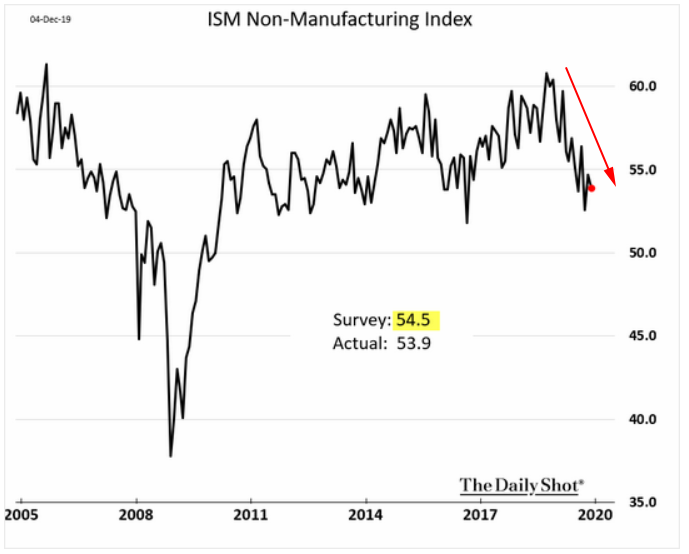

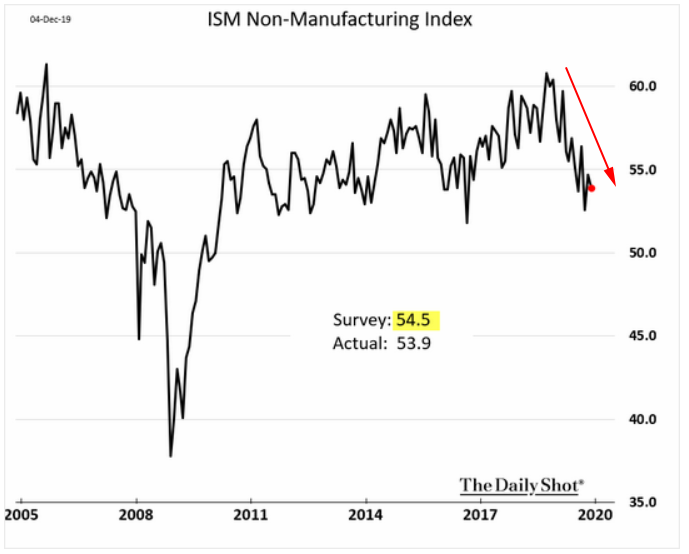

2. So far, the trade war has really only effected manufacturing. However, the trend is also clear for the U.S. services sector; when will the decline halt?

Source: WSJ Daily Shot, from 12/3/19

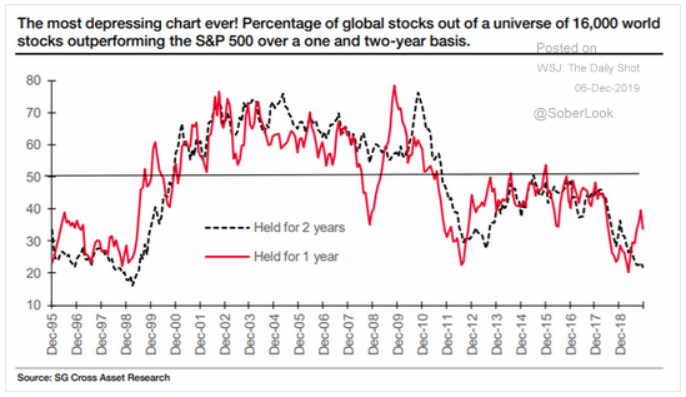

3. U.S. Large cap has dominated for over a decade. Nothing lasts forever, but perhaps we are looking at a 17 year cycle (3 cycles make up a 50 year super-cycle) implying 6 more years of leadership…

Source: WSJ Daily Shot, from 12/6/19

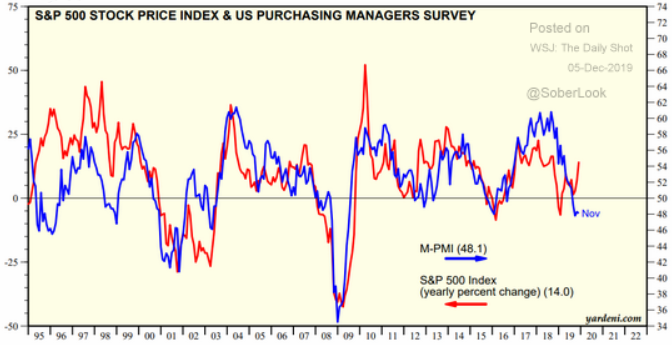

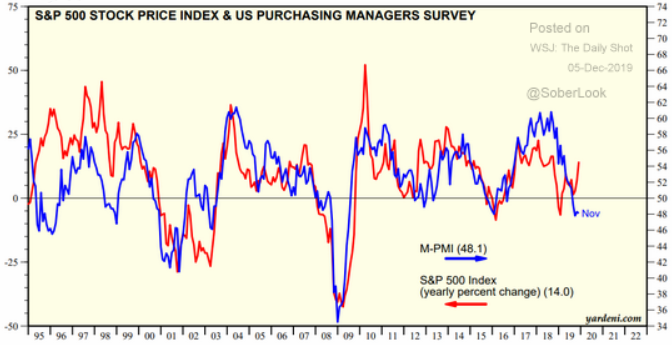

4. Is the stock market predicting a turn in manufacturing? Or is it the other way around and we are in for a “ride”…?

Source: USDA, from 12/4/19

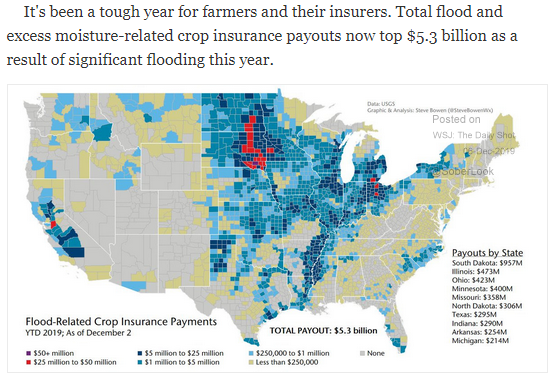

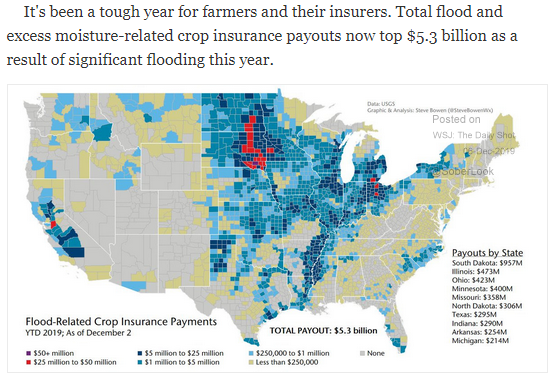

5. You just have to feel for our farmers…

Source: WSJ Daily Shot, from 12/6/19

6. Non-OPEC oil production is soaring!

Source: WSJ Daily Shot, from 12/6/19

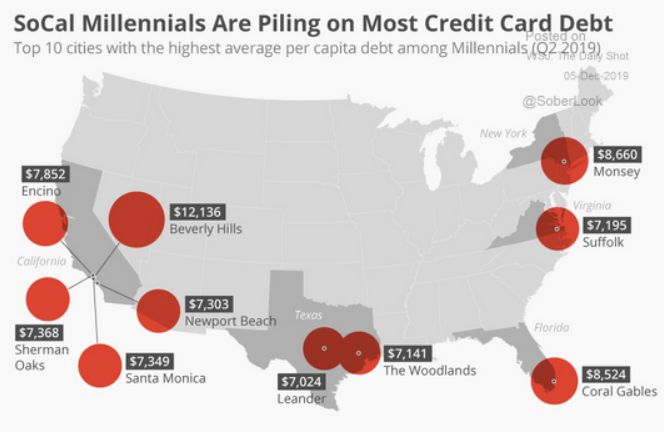

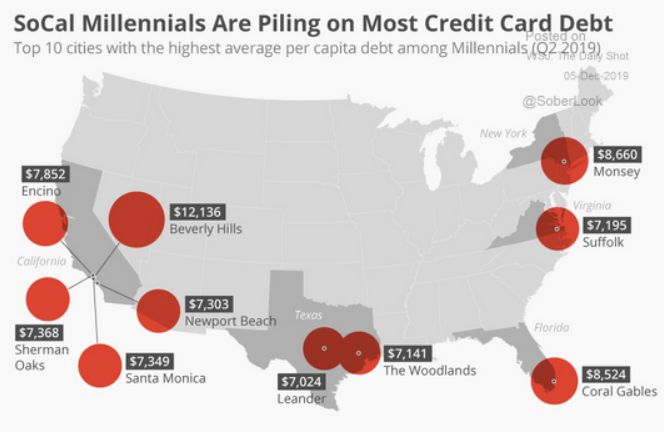

7. A great conversation starter with your client’s children. Not only do they need your help, they will inherit your asset base!

Source: Commerzbank Research, from 12/4/19

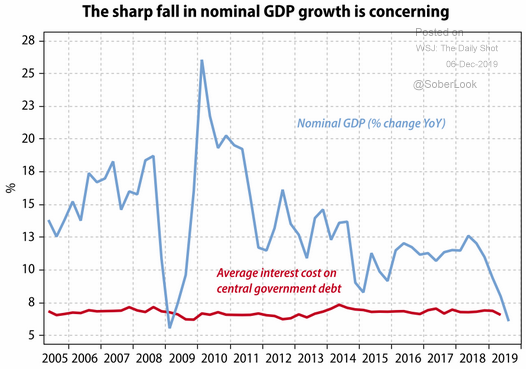

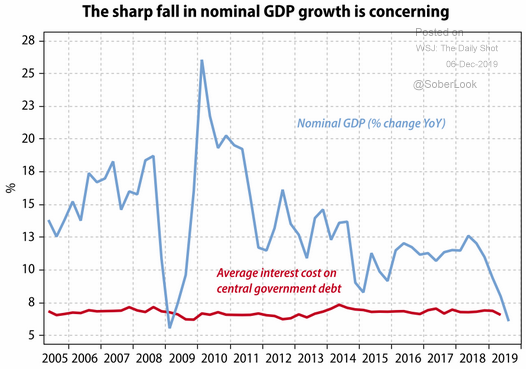

8. The Indian economy, a major player in EM, is struggling.

Source: Gavekal Data & Macrobond, from 12/6/19

Emotions can run high during the holidays, especially when it comes to finances. At BCM, we offer multiple rules-based systems that seek to remove emotion from the investment decision making process and smooth the ride for investors. Click below to tell us what you’re looking for in a portfolio and receive customized information on the BCM strategies that best fit your needs!