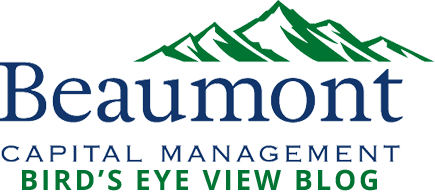

The S&P 500 composite hit an all-time high in late July and is up over 344% from the cycle low point in 2009, but we’ve seen a wedge forming as we progress deeper into the economic cycle. A break-out is coming, but on which side? Meanwhile, yields on the 10-year U.S. Treasury seem to be testing resistance levels and flirting with 2012 and 2016 lows—given the recent Fed actions and bond-market activity, should we expect yields to continue sinking? Real exports of goods and services dropped 5.65% in Q2, erasing all Q1 gains and catapulting the U.S. trade deficit past levels last seen during the global financial crisis. Talks with China are set to resume on October 10th in D.C. and when speaking at the U.N. General Assembly last week, President Trump told reporters that a deal “could happen sooner than you think.” Are you feeling hopeful that we’ll hear news of progress coming out of Washington next week?

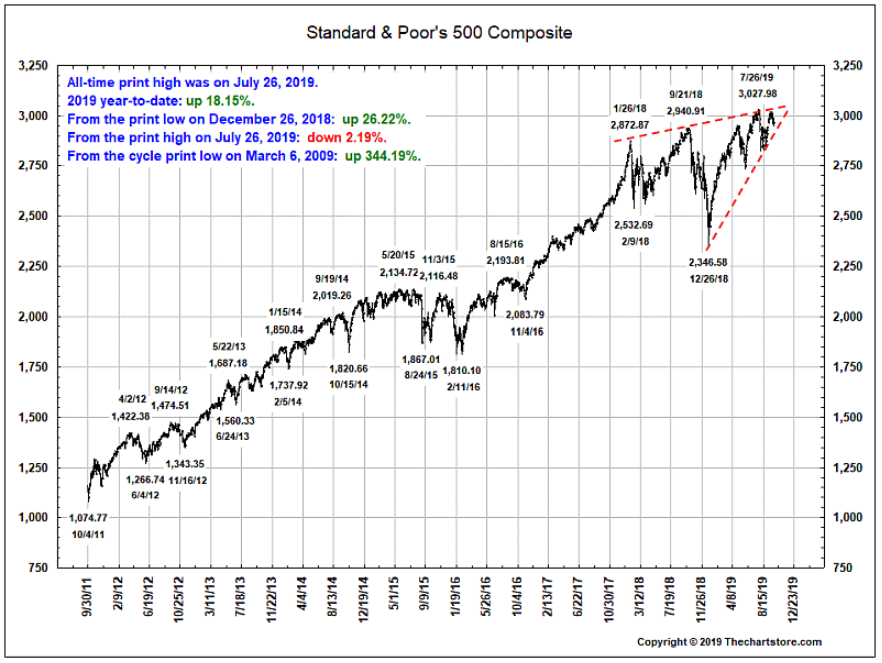

1. Soon there has to be a break-out of this ascending wedge… which way?

Source: The Chart Store, as of 9/27/19

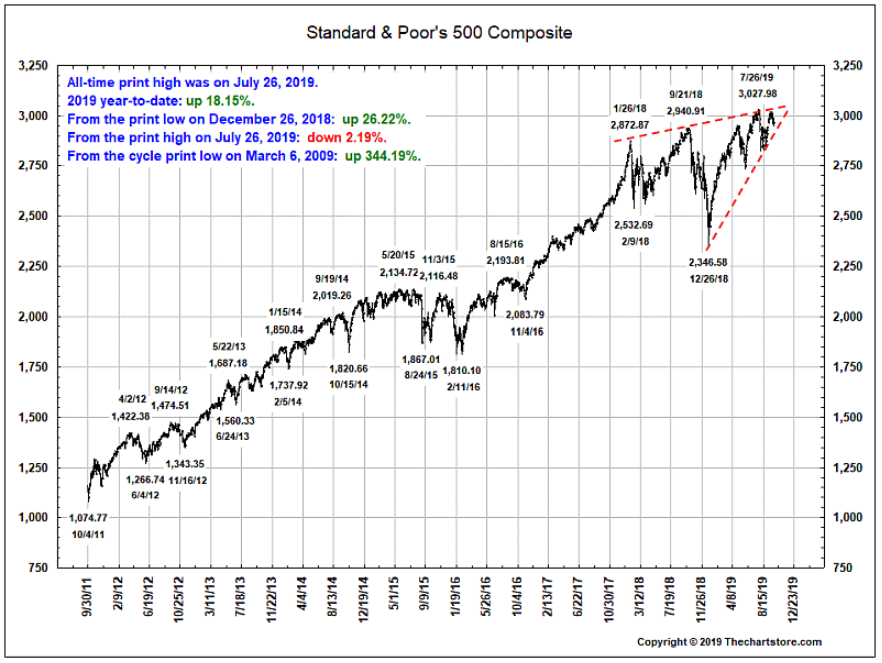

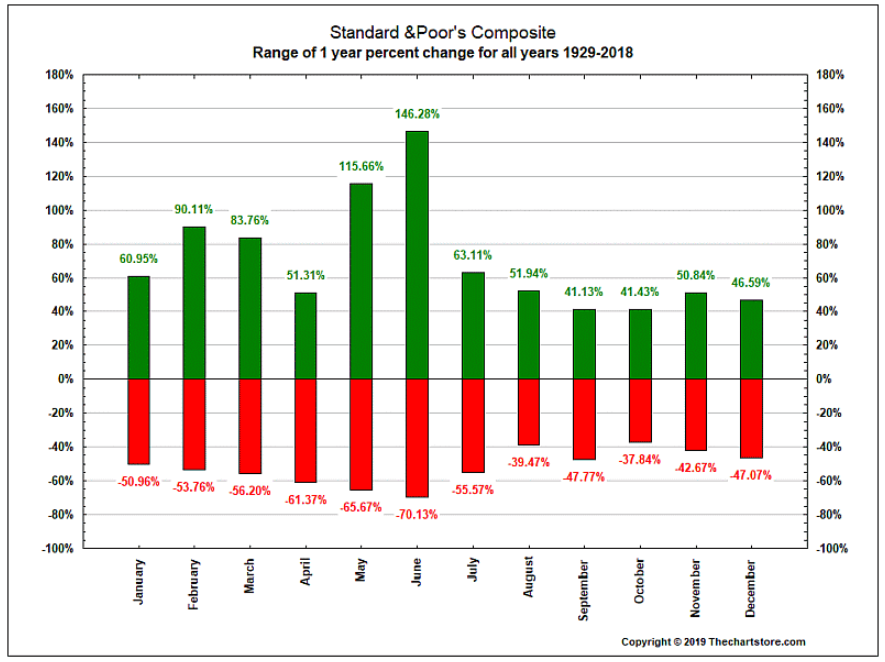

2. In what month is the volatility of the returns the highest?

Source: The Chart Store, as of 9/27/19

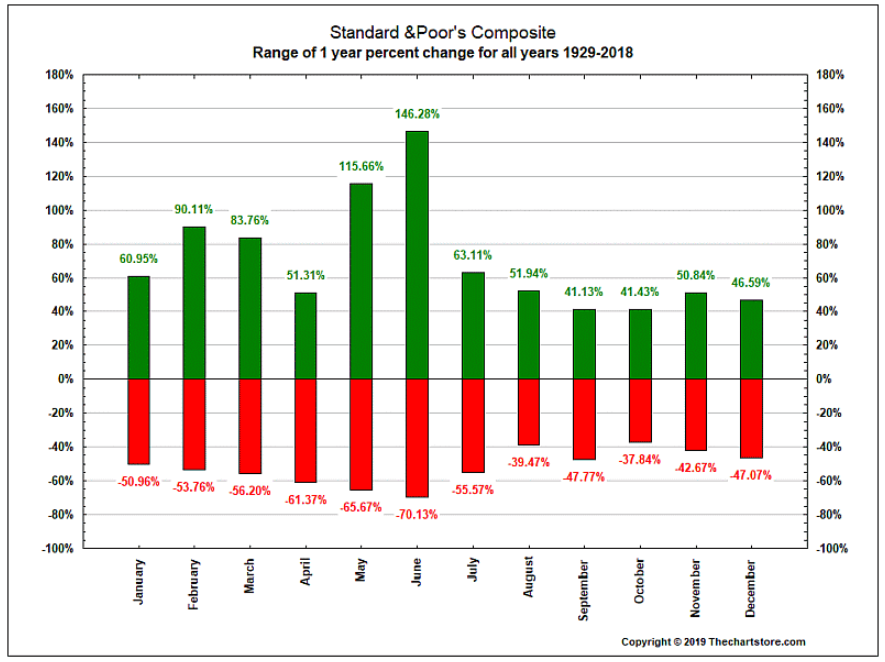

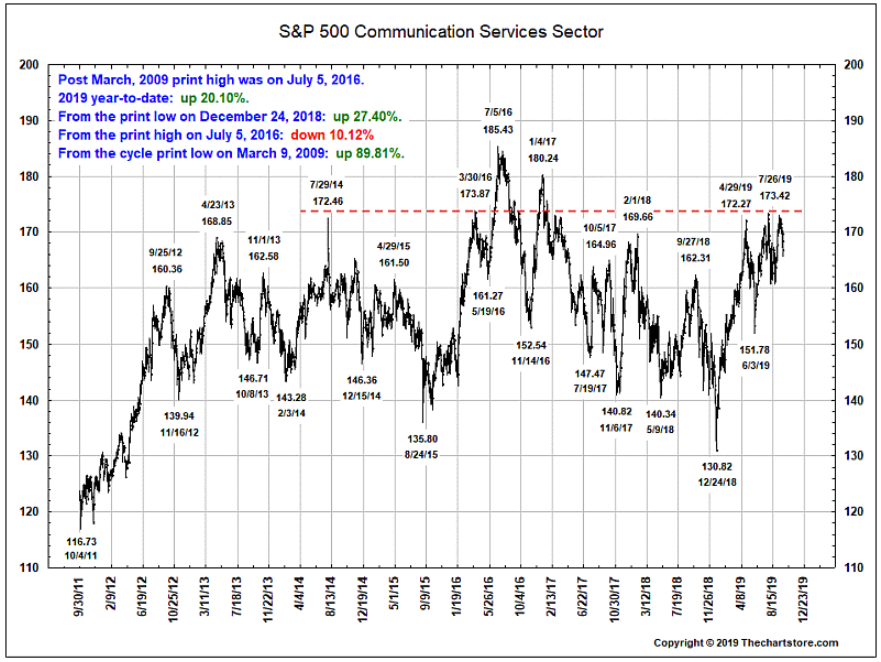

3. In September of 2018, GICS and Dow Jones/S&P Indices added Netflix, CBS, Walt Disney and 15 other media/entertainment companies to the old telecoms. This does not seem to have changed this sector’s behavior…

Source: The Chart Store, as of 9/27/19

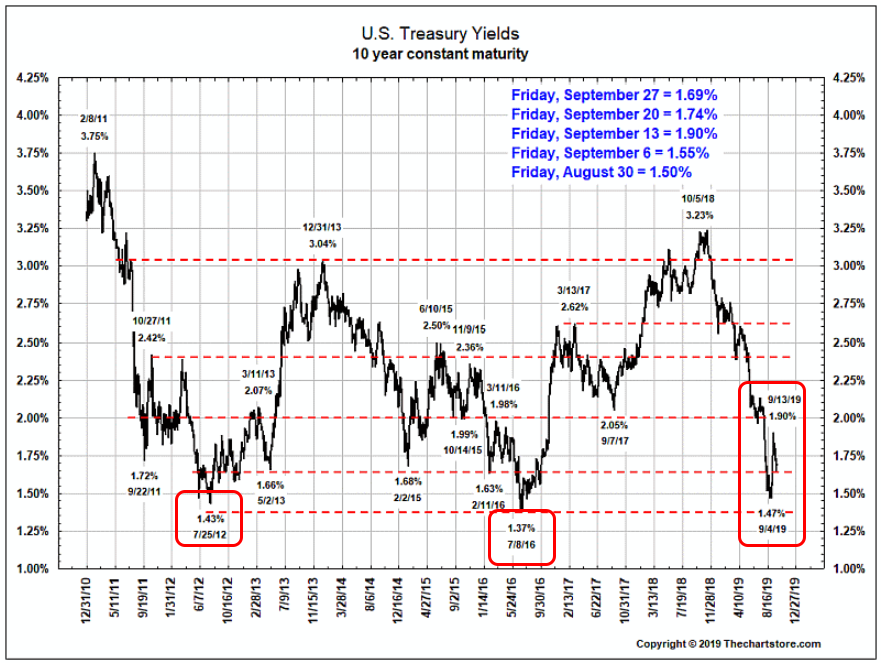

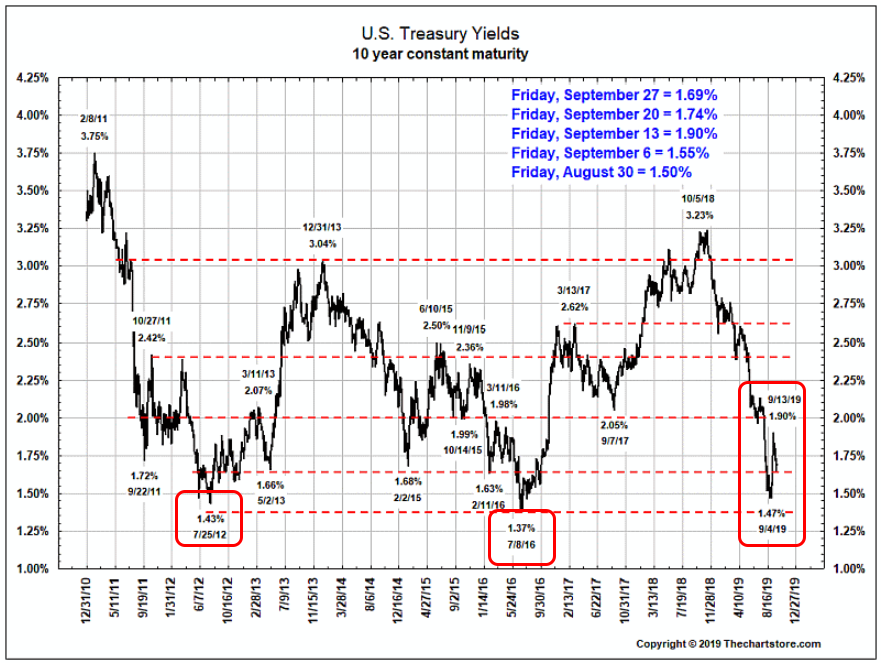

4. Will the yield on the 10-year UST revisit the 2012 and 2016 lows?

Source: The Chart Store, as of 9/27/19

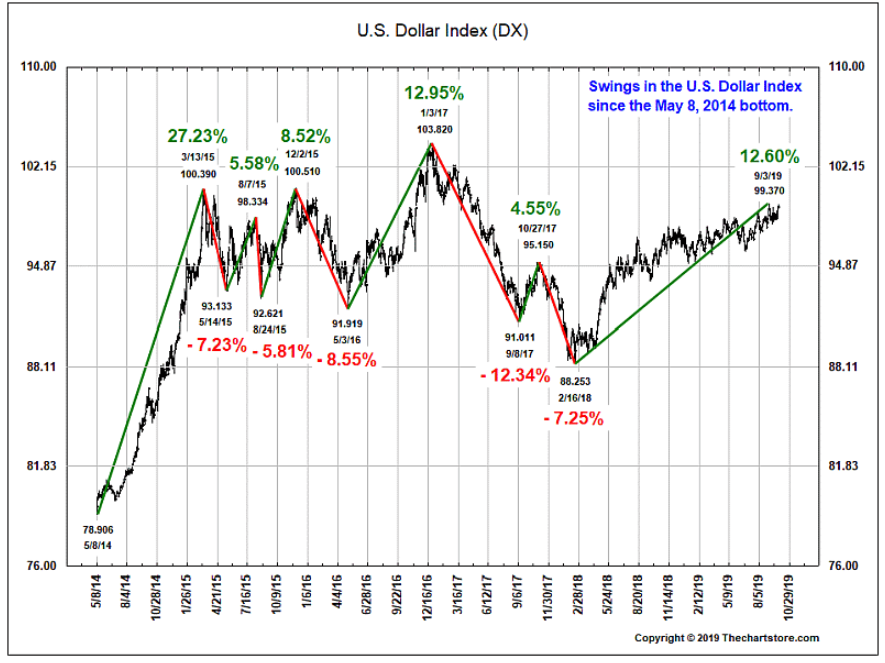

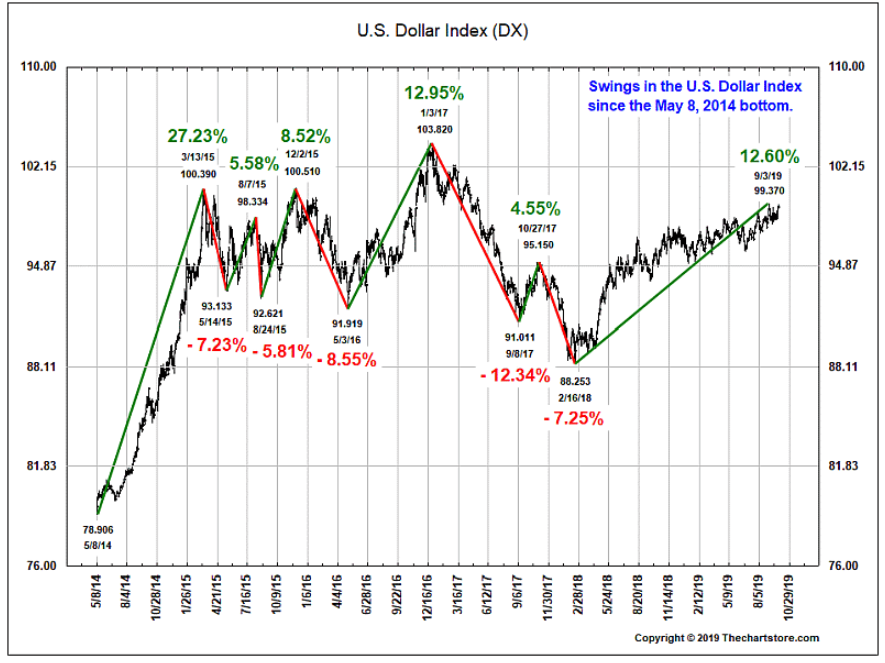

5. The USD continues to grind higher making our goods and service more expensive overseas…

Source: The Chart Store, as of 9/27/19

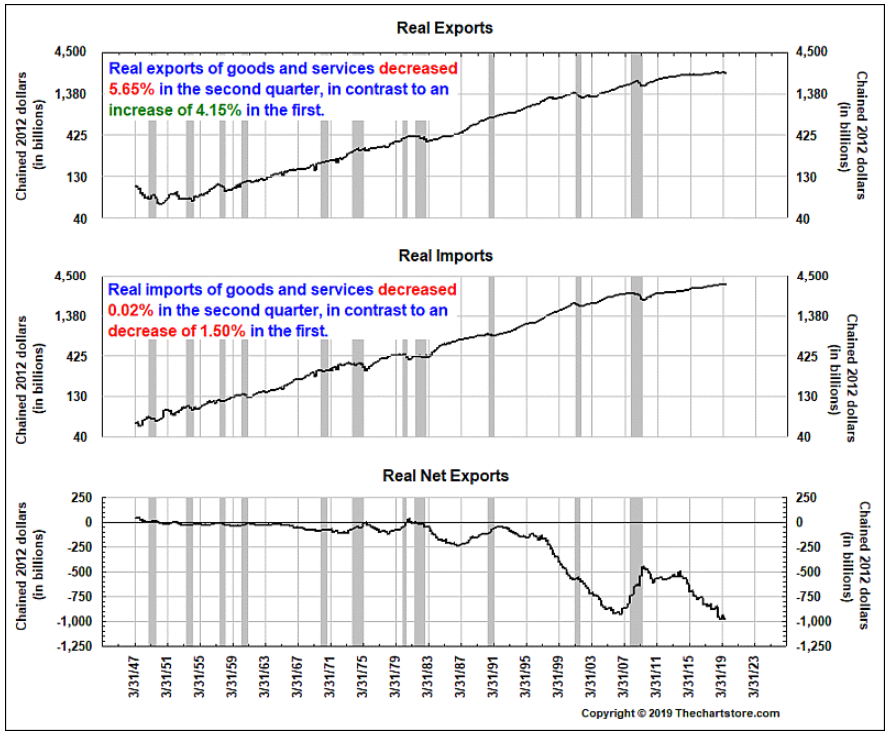

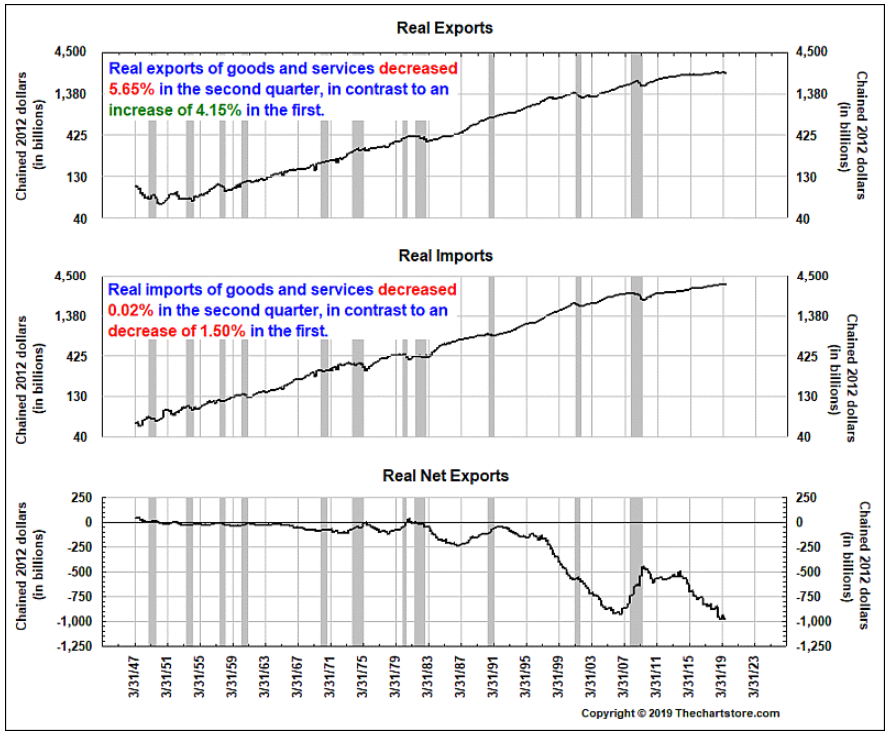

6. The trade war and the last last tax package has helped push our annual trade deficits to levels greater than during the great recession…

Source: The Chart Store, as of 9/27/19

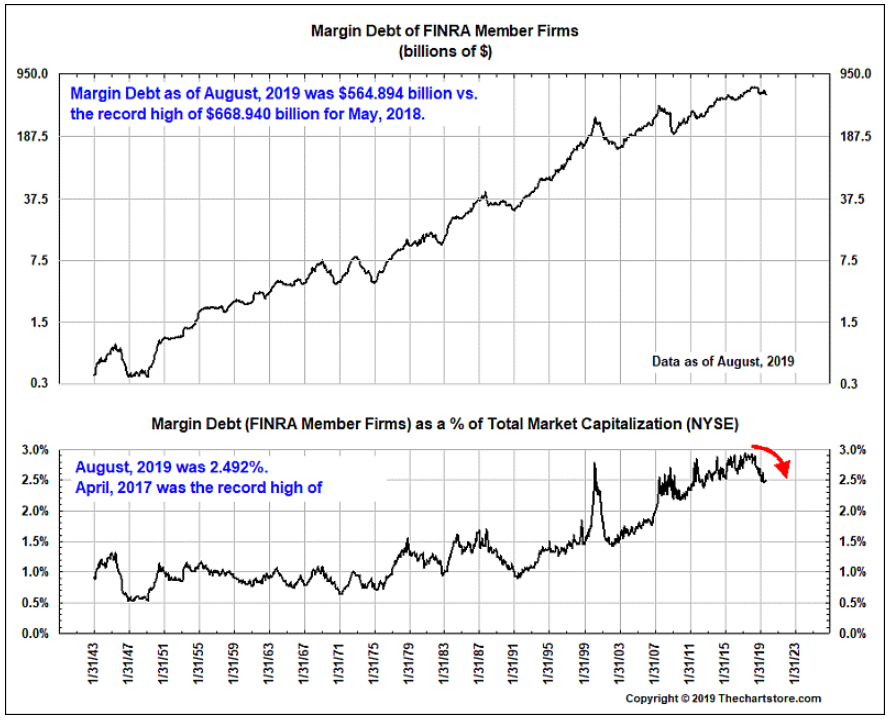

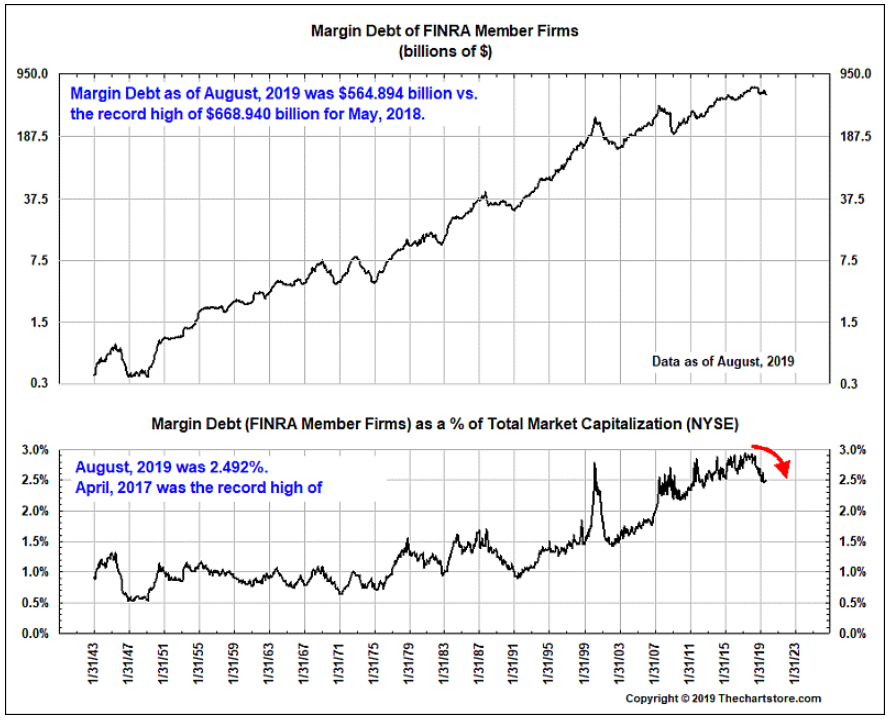

7. A positive sign that the markets are not over-heated?

Source: The Chart Store, as of 9/27/19

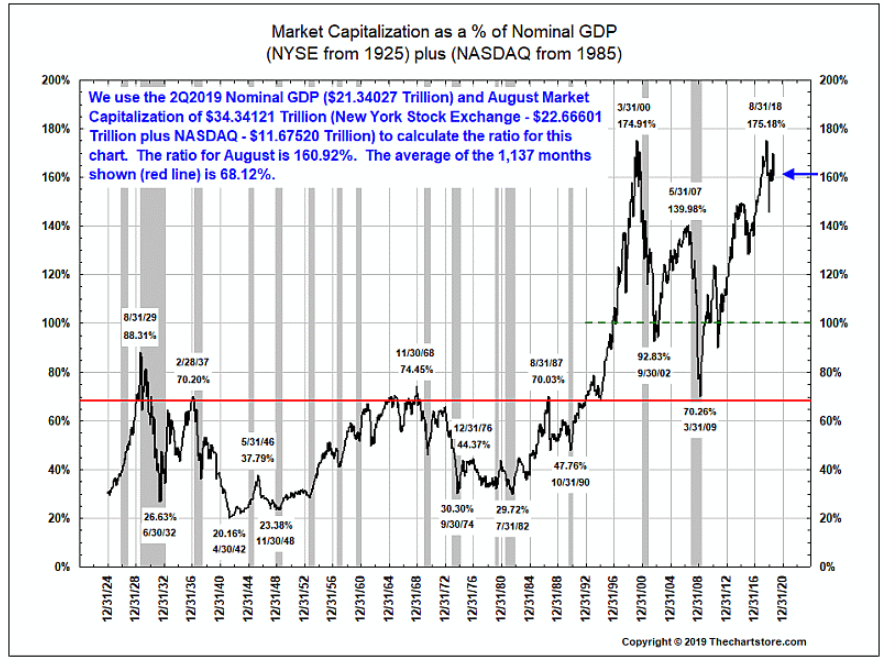

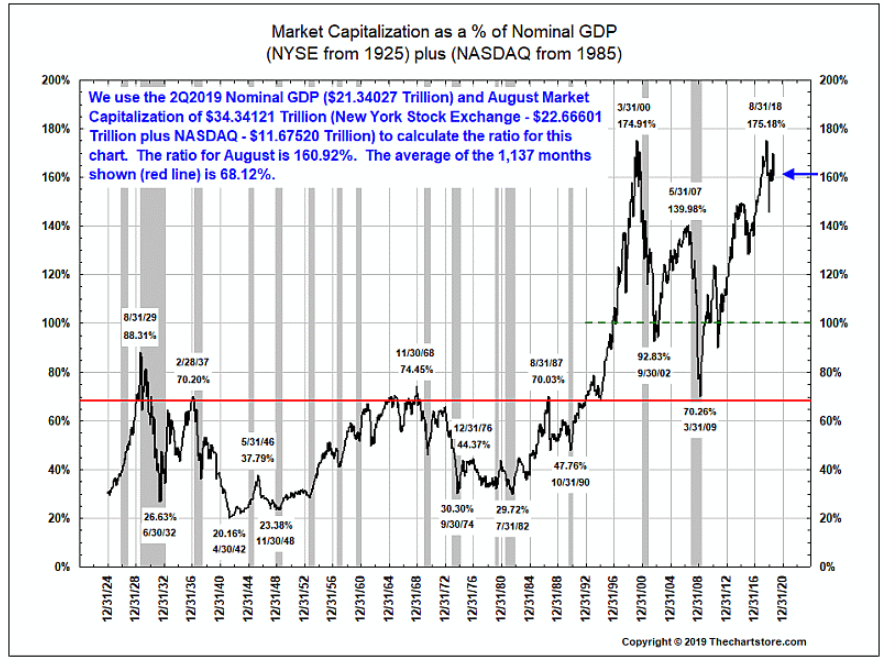

8. On the other hand…

Source: The Chart Store, as of 9/27/19

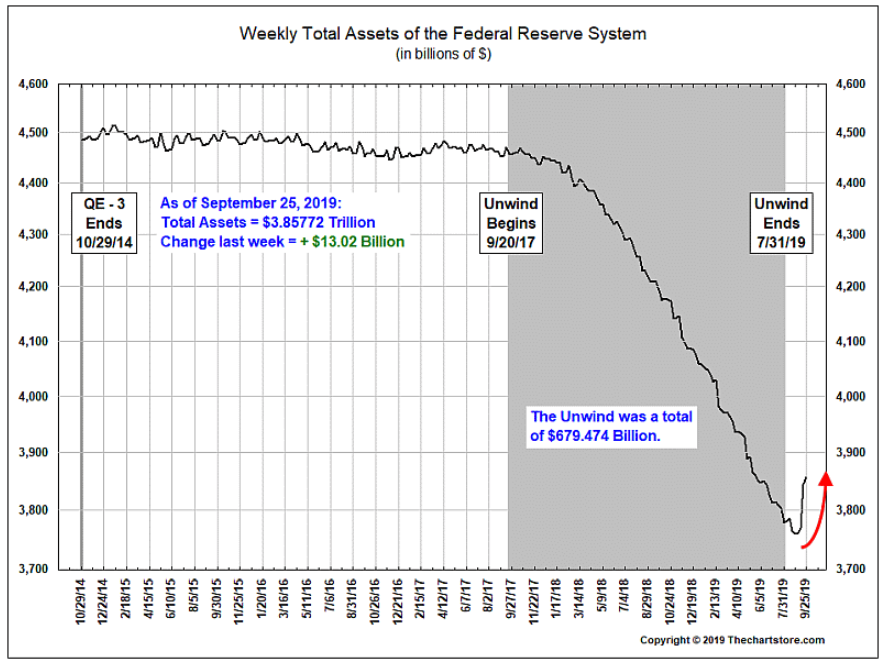

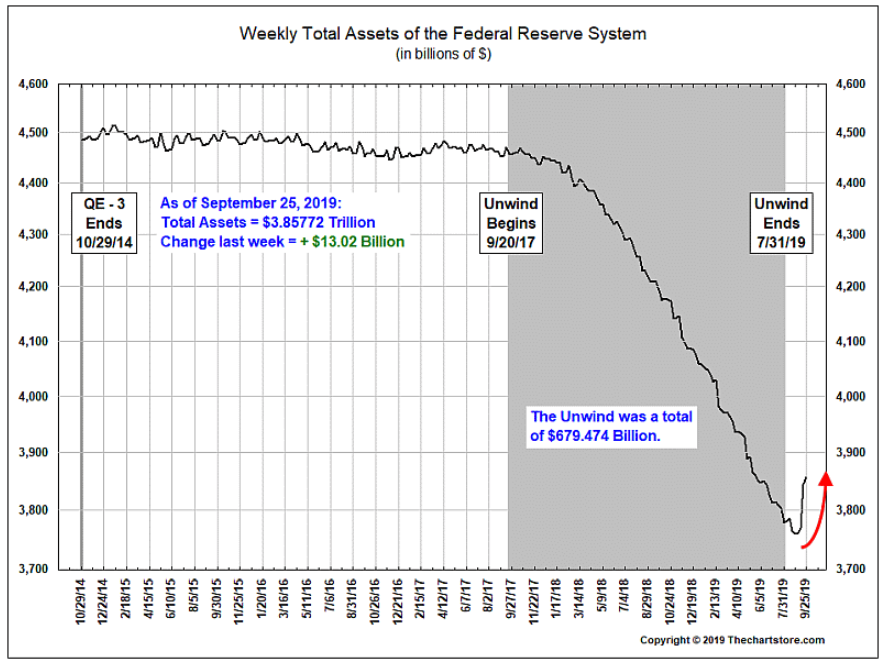

8. Not only did the Fed stop QE reversal stop 2 months early, but it looks like QE is back in full swing!

Source: The Chart Store, as of 9/27/19

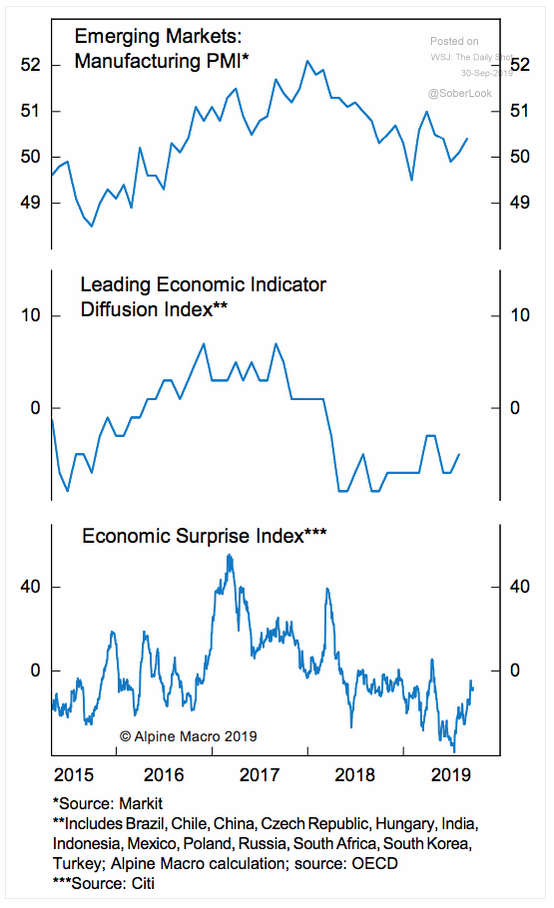

9. Another miss…

Source: WSJ Daily Shot, as of 9/27/19

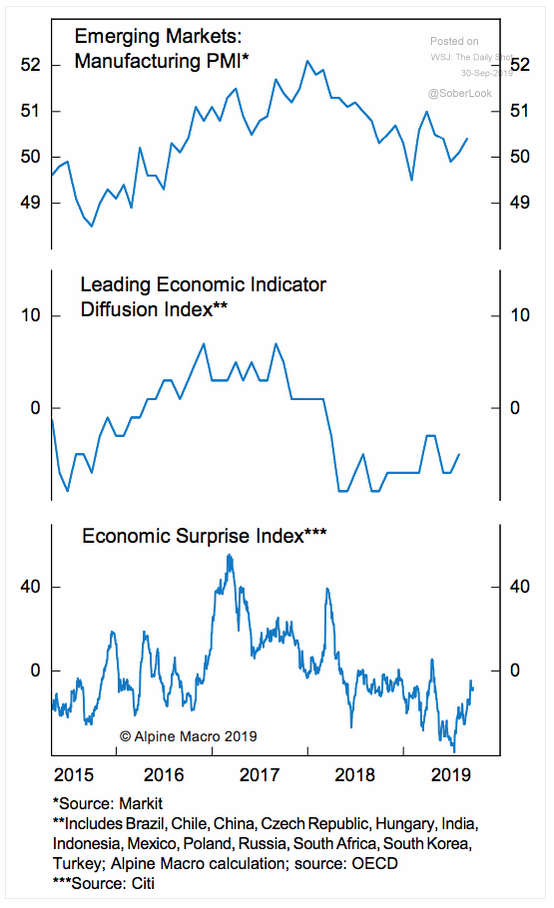

10. Is the EM marketplace gearing up to lead the world out of the manufacturing slump?

Source: Alpine Macro, as of 9/30/19