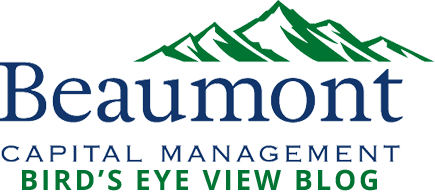

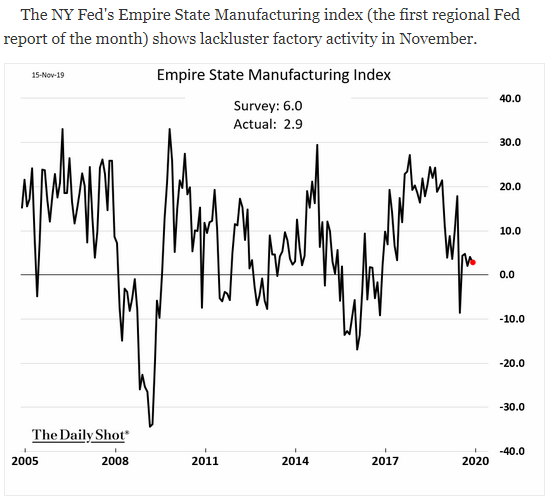

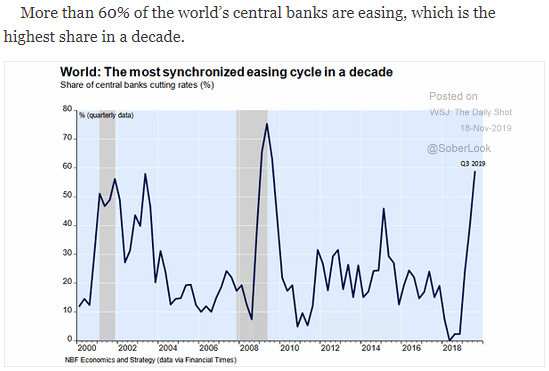

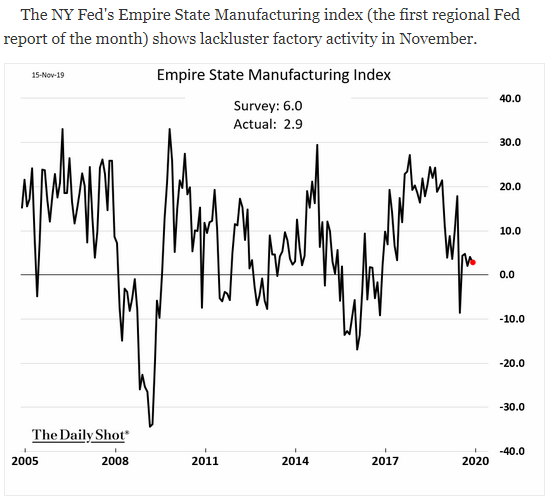

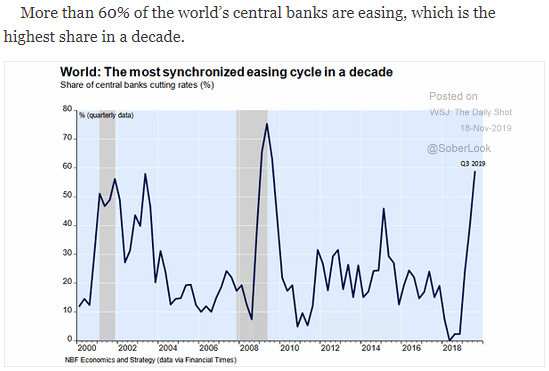

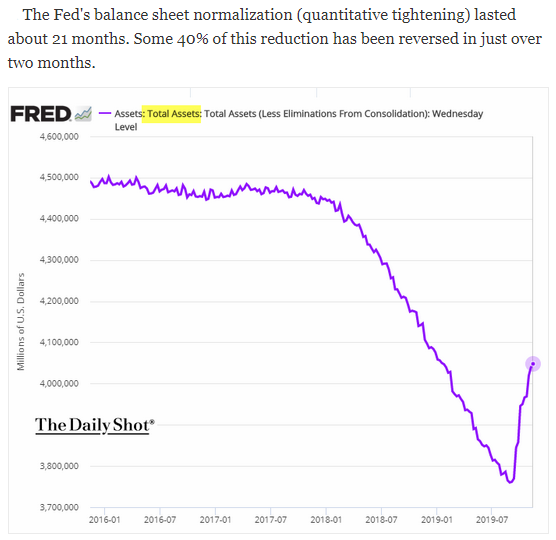

The Empire State Manufacturing index turned in a sluggish 2.9 print on Friday, falling short of expectations and marking six straight months of soft numbers from the oft-prognostic index. With so many regions (both domestic and global) slowing though, it’s worth noting that any reading above 0.0 indicates ongoing growth. Central bankers are almost certainly keeping their eyes on the trend and aiming to act quickly; the highest share of central banks in a decade are now engaged in easing and the Fed’s balance sheet has skyrocketed in just two months. Quantitative tightening went on for almost two years in the U.S.—do you know how much of it has been undone since September? Finally, we (and our government) must realize that spending cannot go on unchecked forever. How are we going to foot the projected $25 trillion bill?

1. At least it is not negative…

Source: WSJ Daily Shot, as of 11/15/19

2. All this after ten+ years of recovery/expansion?

Source: WSJ Daily Shot, from 11/18/19

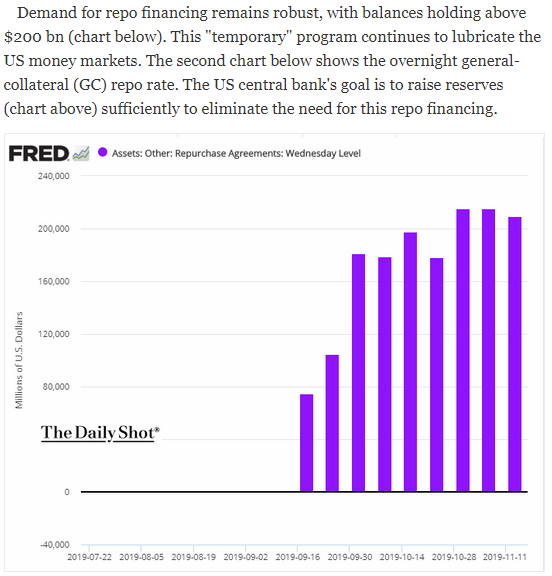

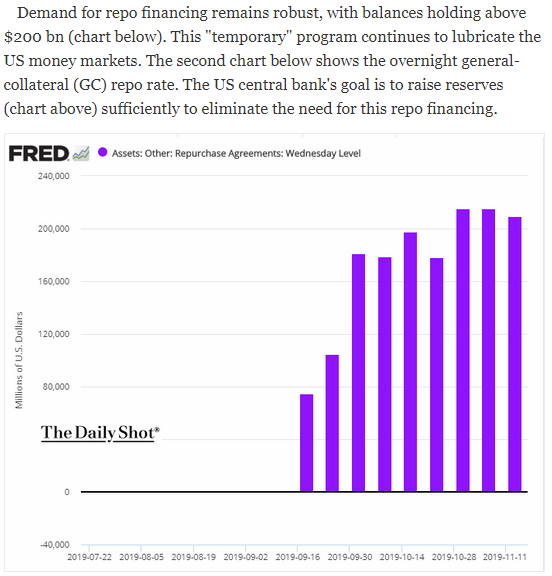

3. Where is the financial press on this one? QE, at least Repo QE, is back!

Source: WSJ Daily Shot, from 11/15/19

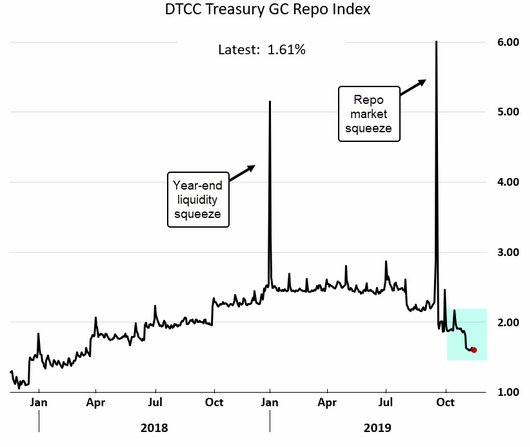

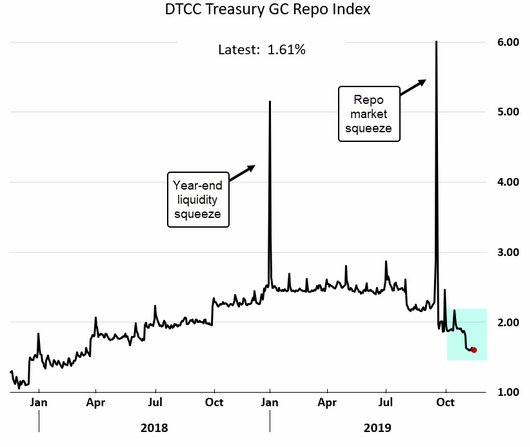

4. The cause:

Source: WSJ Daily Shot, from 11/15/19

5. …and effect:

Source: WSJ Daily Shot, from 11/15/19

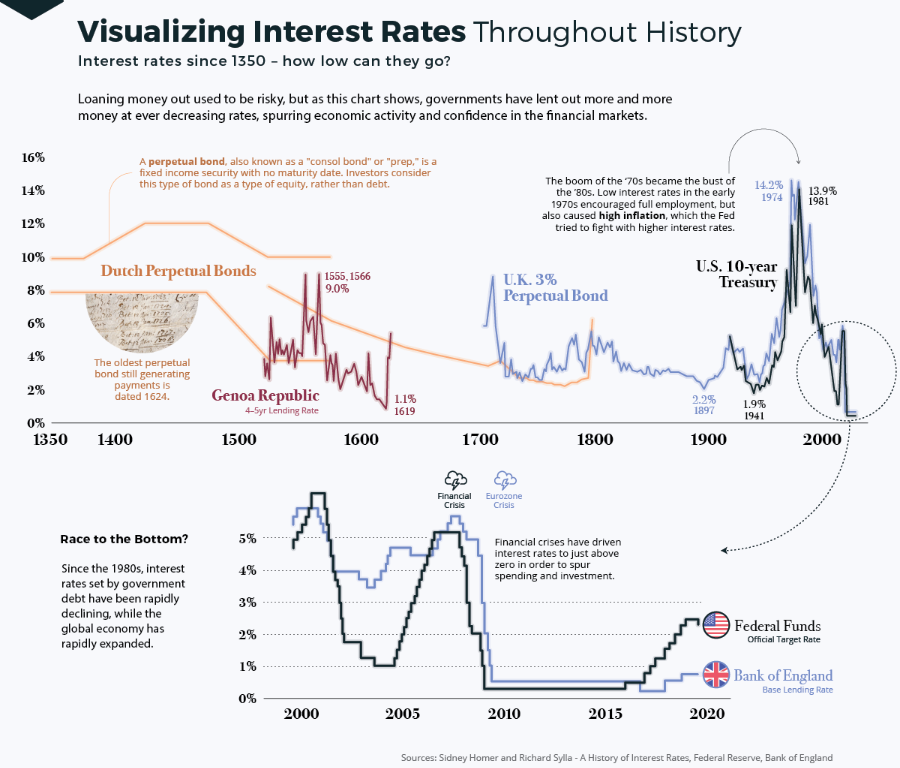

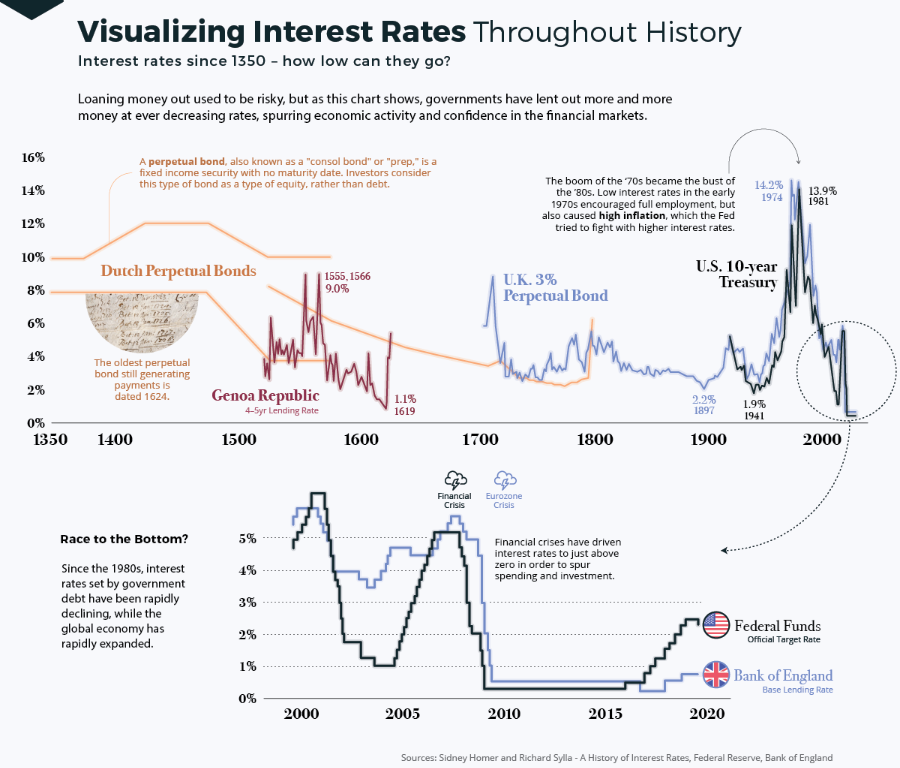

6. As a historian, I love charts like this:

Source: Visual Capitalist, from 11/15/19

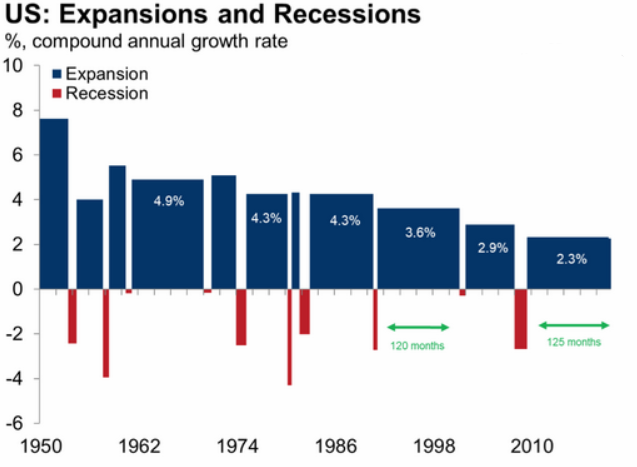

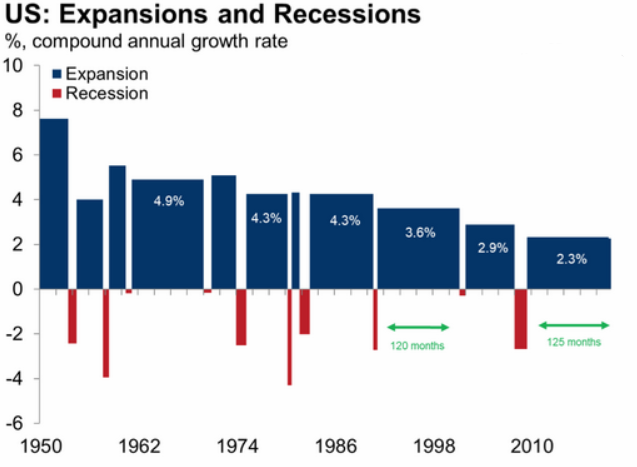

7. While we are enjoying the longest economic expansion post WWII, it has also been the lowest or slowest growth rate. Perhaps that is the key…

Source: Oxford Economics, from 11/15/19

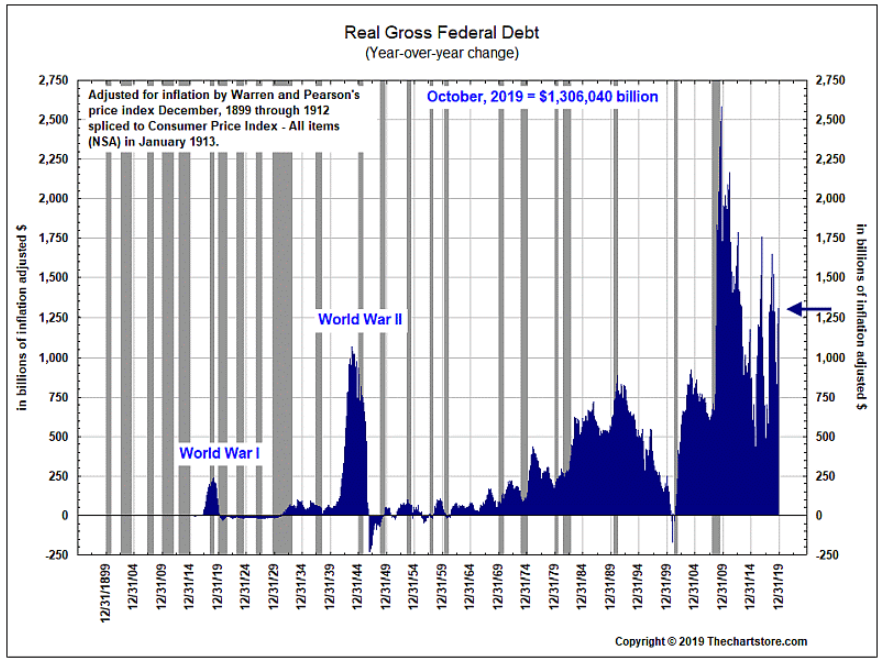

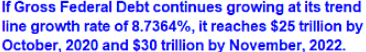

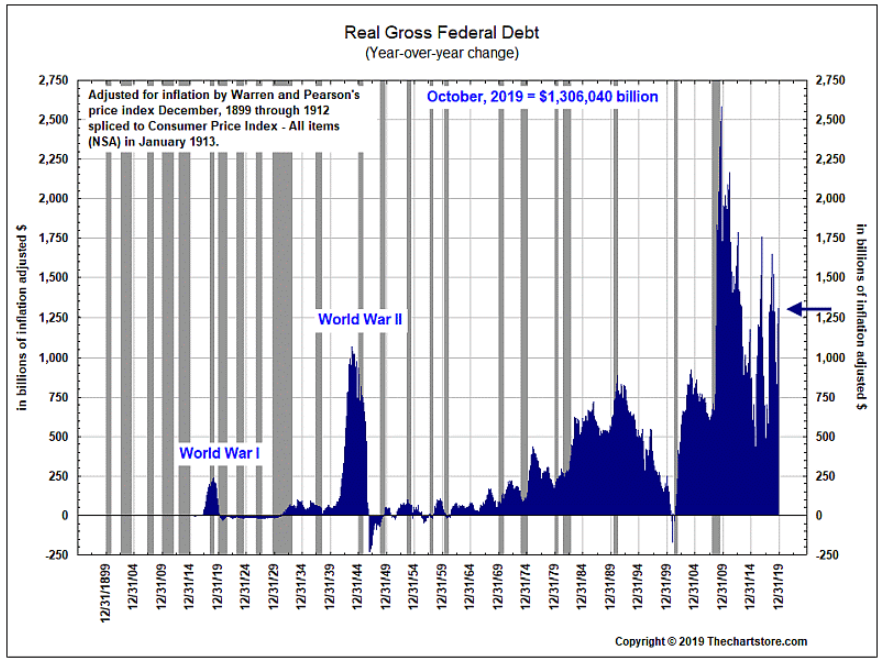

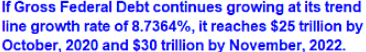

8. Its time to remind Washington that budget deficits, left unchecked, will matter eventually…

Source: The Chart Store, as of 11/15/19

9. While all of our wars are expensive (in more ways than one), we are not fighting WWII, but we are amassing deficits like we are…

Source: The Chart Store, as of 10/31/19

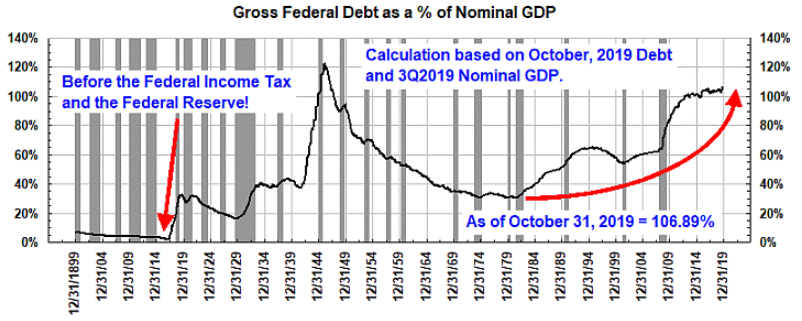

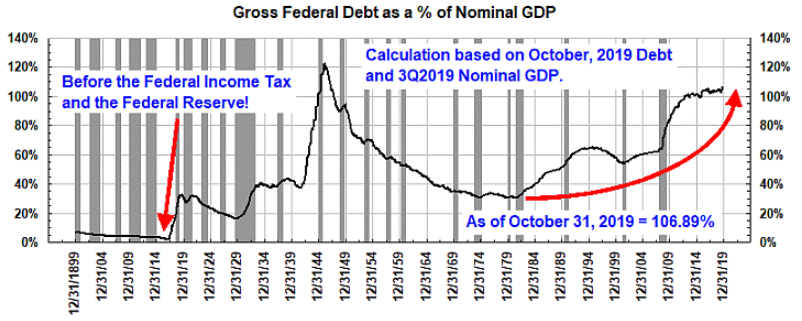

10. A five year view on the USD and the currencies it trades against:

Source: The Chart Store, as of 11/15/19