Written by BCM Investment Team

BCM 1Q20 Market Commentary: To V or Not to V, That Is the Question…

April 7, 2020 | COMMENTARY

With apologies to Mr. Shakespeare…

The Covid-19 pandemic has set upon the globe with lightning speed and is unlikely to leave us anytime soon. First and foremost, we hope that you, your family and loved ones are well. While the level of disruption that the virus has caused to our daily lives is unprecedented, we wish to offer hope with a healthy dose of realism.

As confirmed global infections surged past three-quarters of a million people on April 1st, we are reminded of the importance of staying home, incessantly washing our hands, and setting proper social distancing if we must venture out. Unfortunately, the inconsistent spread and response across our country will only delay victory. Different states and municipalities will enter lockdown while others delay or prematurely emerge, potentially spreading the infection anew. This timing and coordinated response issue is likely to compound exponentially with the rest of the world involved. However, this is the United States of America, and betting against us has never been a good idea. It may take more time, economic writhing and pain before any semblance of normalcy returns but with resolve, determination and compassion, we can end this pandemic.

Moving on to the markets, the first quarter of 2020 was historic. The list of extraordinary, if not record-setting, events includes:

- The fastest bear market ever, taking roughly half the time of 1987. Since WWII, the average bear took 8 months to unfold, this one took, so far, less than one month.

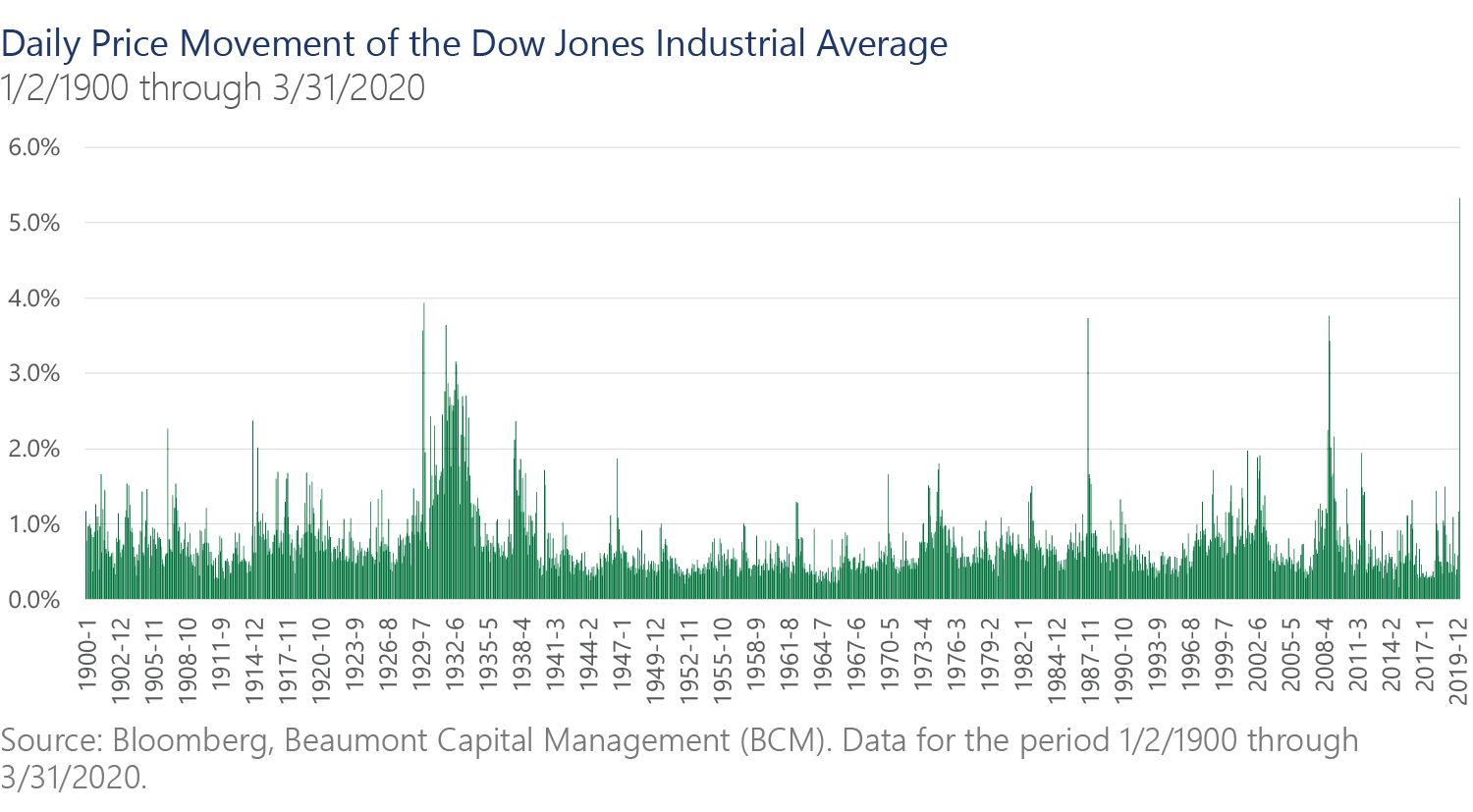

- The most 4%+ and indeed also the most 9%+ moves in the Dow Jones Industrial Average in any year since 1929

- A record high in the VIX (the CBOE volatility index)

- A massive oil market shock. The Saudi-Russian oil feud, a true “black swan,” changed the entire landscape of the oil market overnight. Over the course of the quarter, the price of oil fell nearly two-thirds including a decline of nearly 30% in a single day.

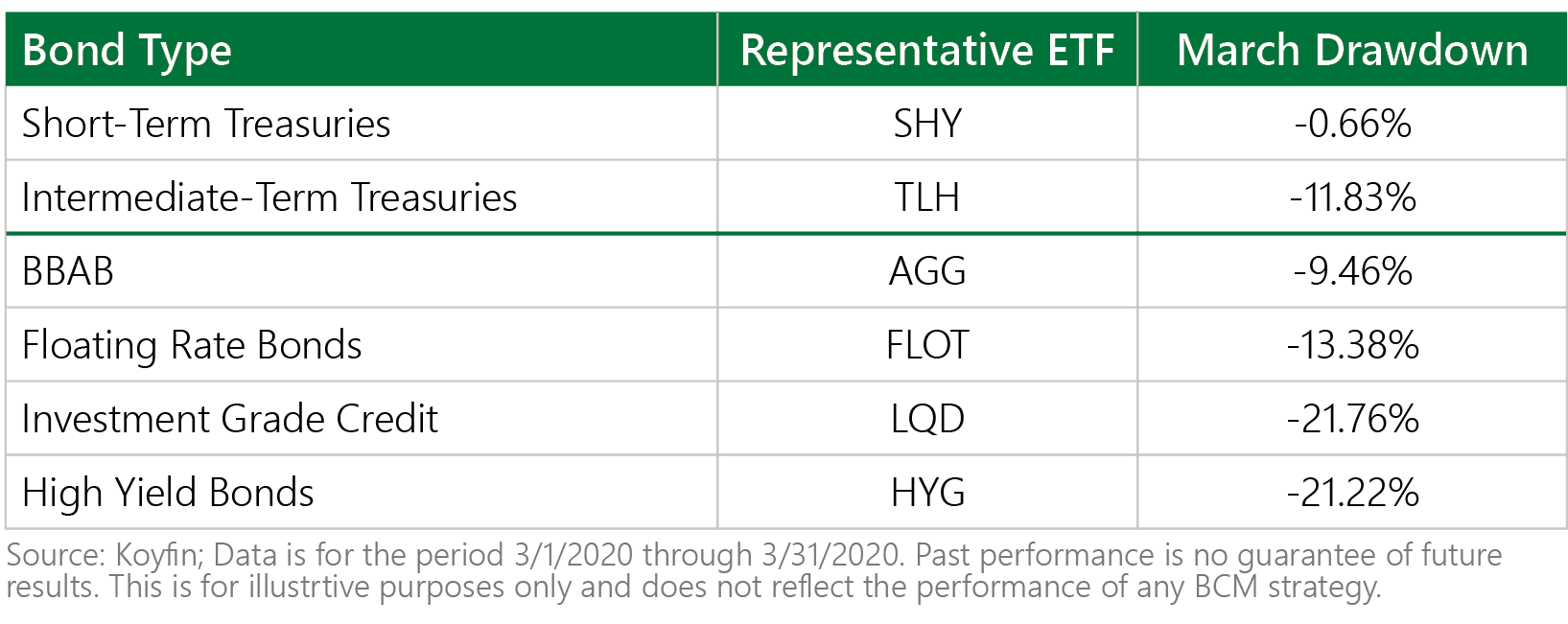

- Unparalleled volatility in the bond markets. Bonds, which entered the bear market with record low yields and credit spreads, offered less “protection” than any previous bear market. In fact, at the peak of the stock drawdown, bonds fell as well:

Suffice to say this bear market was unprecedented in terms of speed, explosiveness and breadth. The peak drawdown in the S&P 500® Index has been 33.9% so far, yet this may understate the general damage to investors as two of its largest sectors, Technology and Healthcare, substantially outperformed. Small-Caps, for example, incurred a significantly larger drawdown of over 42%, and now are barely positive on a trailing 5-year basis.

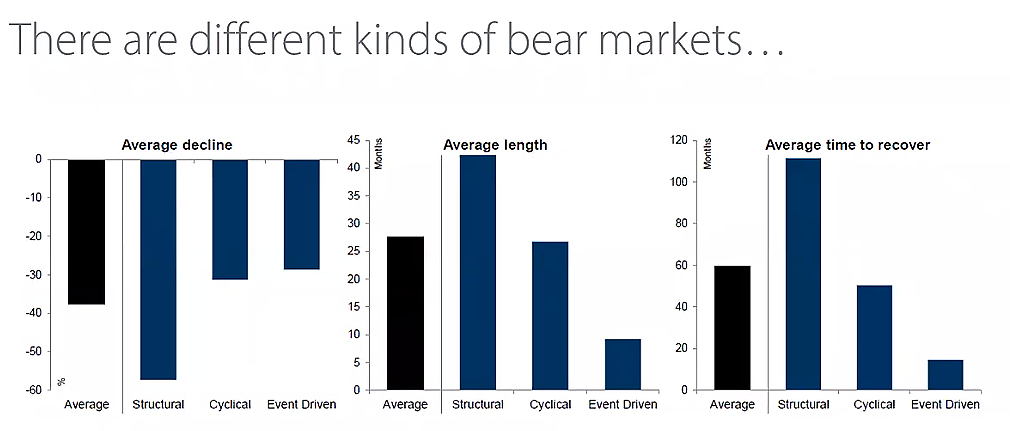

It is important to note that the end of the recent bull market and economic expansion was not caused by a misallocation of capital such as the excesses seen in 1999 and 2007. This is a self-induced, global economic shutdown necessitated by public safety. While it is impossible for anyone to know when and what is going to happen, with history as our pilot, this is likely going to take several quarters to several years to conclude. We first wrote about the Anatomy of a Bear Market several years ago and you can read the article here.

We believe that the duration of the pandemic will depend on what the “second-order” or spillover effects of this event are. It will also deeply depend on the diligence of people’s response (quarantine/social distancing) and whether government authorities rush to lift such preventative measures. If the flu pandemic of 1918-21 is a guide, there will be more than one wave of this pandemic before a vaccine is found and globally distributed. For example, most new cases in China are now being brought into their country from abroad. Covid-19 is so contagious, and so many victims are asymptomatic, that flare-ups across the globe and the resulting future quarantines will likely delay full economic recovery for some time.

The effects on our lives, our economy and our way of life are still being realized. We have seen airline traffic plummet 94%1, regional manufacturing fell up to 70%2, and millions of newly unemployed or furloughed workers. Corporate America borrowed almost $200 billion more in March alone3, much of this against their credit facilities. The scale of the disruption by itself is unnerving and as more data pours in, the specter of a quick economic recovery fades by the day.

The economy, especially the U.S. consumer, was very healthy going into 2020. If the economy can be “kept alive” with some of the supportive measures we discuss below, we could have a reasonably quick recovery as we are perhaps beginning to see in Asia. However, should this shock cause systemic damage, we may be looking at a traditional “business cycle reset,” akin to a cyclical or structural bear market, which is often a significantly more painful experience for investors.

Source: Goldman Sachs, Eventide Asset Management; as of 3/12/2020.

On the positive side, this hasn’t been a traditional financial crisis. With no misallocation of capital as mentioned above, essentially no one is to blame. We believe this has played a major role in how quickly both governments and central banks around the world have been able to act. The U.S. Federal Reserve has taken quick and decisive actions as they:

- Cut interest rates twice to “near zero” intra-meeting

- Bought ~$1 trillion of U.S. Treasuries and mortgage backed securities

- Backstopped the repurchase (repo) market with as much as $1.5 trillion4

- Re-opened the discount window to banks as an additional source of capital for loans5

- Re-opened the Commercial Paper Funding Facility to lend directly to U.S. business when the need arises6

- Opened swap lines of credit to 14 central banks across the globe to provide near-zero rates to those in need of dollars overseas7

Thus far, we have seen the U.S. Government produce a stimulus bill of $2.2 trillion…about 10% of our pre-crisis GDP. This is almost twice what the stimulus package of 2009 provided. The U.S. is not alone…Fiscal and monetary stimulus has been enacted in China, Europe, Japan, U.K., Australia, Canada and many more countries. Will it be enough?

Our three investment systems all share the same philosophy and purpose, but they go about it in different ways. Each is designed to reduce drawdown and volatility, but they were all trained on the past. The speed of recent events challenged the norm…all past bear markets, including 1987, took months or years to unfold…yet this one took weeks. While we are generally pleased with our performance, it is always wise to learn and adapt from recent events. Volatility always unearths opportunities for improvement, and we will continue to improve our processes and models to the best of our ability.

We seek to be the best possible stewards of our clients’ capital, and we thank you for your continued support.

Sources and Disclosures:

1 WSJ Daily Shot, 3/28/20

2,3 WSJ Daily Shot, from 3/30/2020

4,5,6,7 “What the Federal Reserve Can Do to Fight Recession.” Wall Street Journal, 3/26/20. https://www.wsj.com/video/what-the-federal-

reserve-can-do-to-fight-recession/D23403CC-088F-472C-848A-814BC1829E74.html

Copyright © 2020 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Past performance is no guarantee of future results. Index performance is shown on a gross basis and an investment cannot be made directly in an index. The performance of any ETFs, as contributors or detractors to the strategy, are provided on a gross basis. An Exchange Traded Fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold. All BCM strategies invest only in long-only ETFs.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry, and the investments’ performance could depend heavily on the performance of that industry and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic

uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk.

Diversification does not ensure a profit or guarantee against a loss.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. The S&P Small Cap 600® Index is an unmanaged index that tracks the performance of 600 widely held, small-capitalization U.S. stocks. The MSCI World Index is a free float-adjusted market

capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets and 26 Emerging Markets countries. The MSCI ACWI Index ex-U.S. captures large and mid-cap representation across 22

Developed Markets and 26 Emerging Markets countries, excluding the United States. The Bloomberg Barclay’s U.S. Aggregate Bond Index is a broad base index and is often used to represent investment grade bonds being traded in the United States.

“S&P 500®”, and “S&P Small Cap 600®” are registered trademarks of Standard & Poor’s, Inc., a division of S&P Global, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

The BCM investment strategies may not be appropriate for everyone. Due to the periodic rebalancing nature of our strategies, they may not be appropriate for those investors who desire regular withdrawals or frequent deposits.

For Investment Professional use with clients, not for independent distribution. Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management was originally created in 2009 as a separate division of Beaumont Financial Partners, LLC. Beaumont Capital Management LLC spun off as its own entity as of 1/2/2020. Beaumont Financial Partners, LLC was originally registered as

Beaumont Trust Associates in 1981 and was reorganized into Beaumont Financial Partners, LLC in 1999.

Beaumont Capital Management LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)

Popular Posts

- Financial Sector Breakout, Record Setting Trade Deficits, Underwhelming Regional Fed Reports

- BCM 3Q19 Market Commentary: Blinking Yellow Lights

- Unemployment Plateaus, Good News for Banks, and a Look at Post-Recession EPS Recoveries

- Service Sector Recovery, Good News from Dr. Copper, and Remember the Trade War?

- Unemployment Climbs, Strong Recoveries from Retail & Manufacturing, and Trouble for High Yield