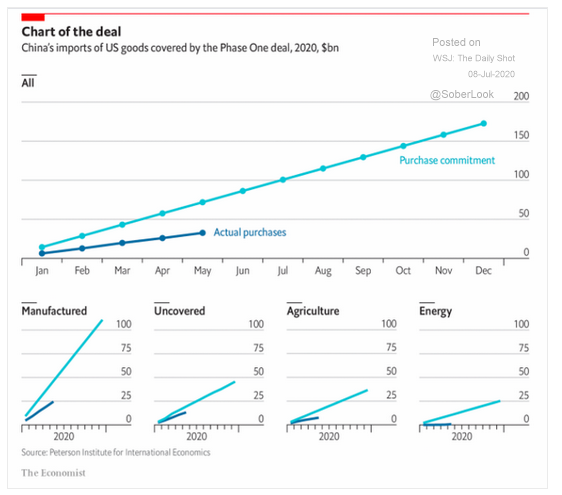

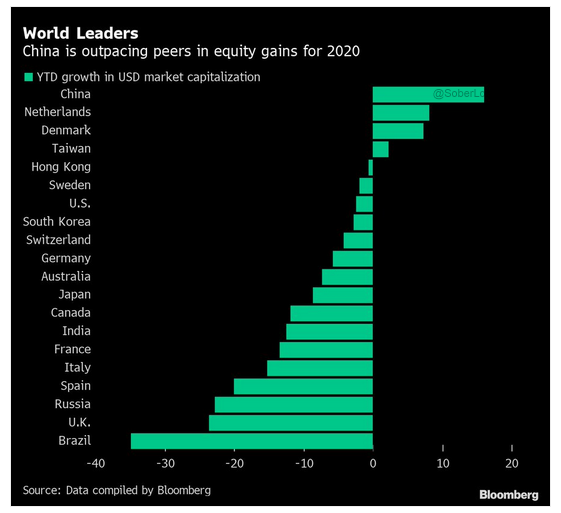

The U.S. services sector shot back to nearly pre-pandemic levels in June, significantly outperforming expectations as over 80% of industries reported seeing growth in business activity. That growth doesn’t look strong enough yet to welcome back all laid-off or furloughed workers though; permanent job losses are still climbing even as new claims continue to slow. The travel industry has been one of the hardest hit by the pandemic, and though it received a temporary bump over the holiday weekend, air travel is down 72% from 2019 and business travel in particular has virtually ground to a halt. Dr. Copper doesn’t appear too concerned though; the keystone commodity has been steadily creeping higher and has more than recovered its Covid-sparked losses. Bond holders likely aren’t feeling quite as calm these days though—U.S. investment-grade yields are at record lows and systemic risks are on the rise as financing costs collapse and market-based inflation expectations have been picking up. And remember the trade war? It may have been knocked off the front page by 2020’s other major headline events, but China’s failure to honor the phase one deal should not be overlooked and could complicate negotiations going forward. China’s leading the world for equity gains in 2020 and looks to have moved past the worst of the Covid-19 threat, but can we expect U.S. imports to ramp up enough to hit the deal’s targets when they’re less than a quarter of the way there?

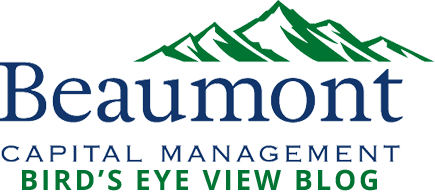

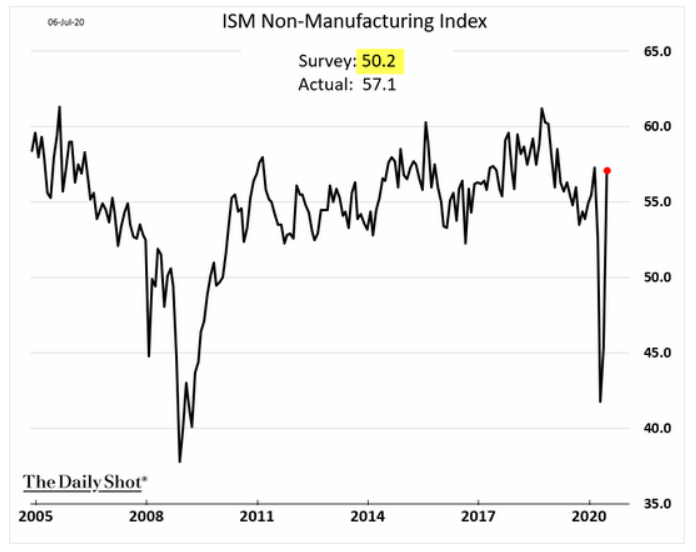

1. The U.S. service sector has come roaring back to growth mode (greater than 50).

Source: WSJ Daily Shot, from 7/7/20

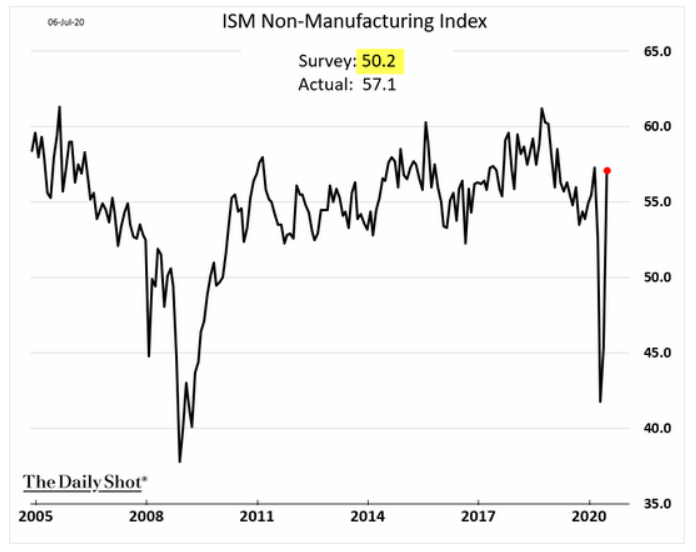

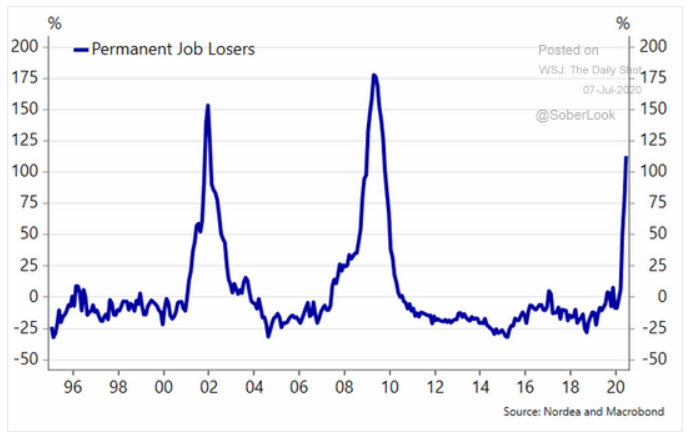

2. Certain segments of the economy, still closed due to the virus, continue to suffer…

Source: WSJ Daily Shot, from 7/7/20

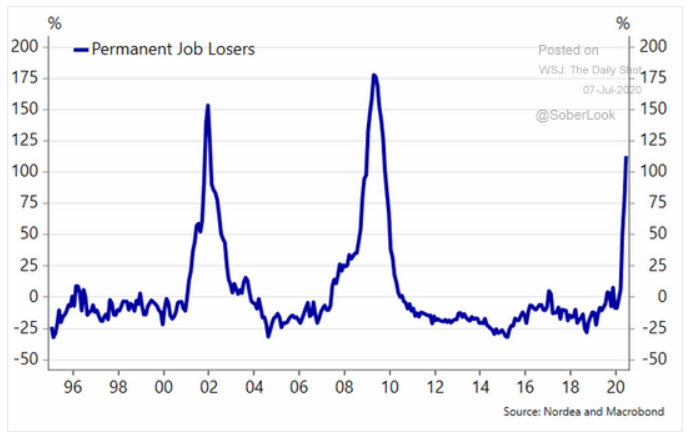

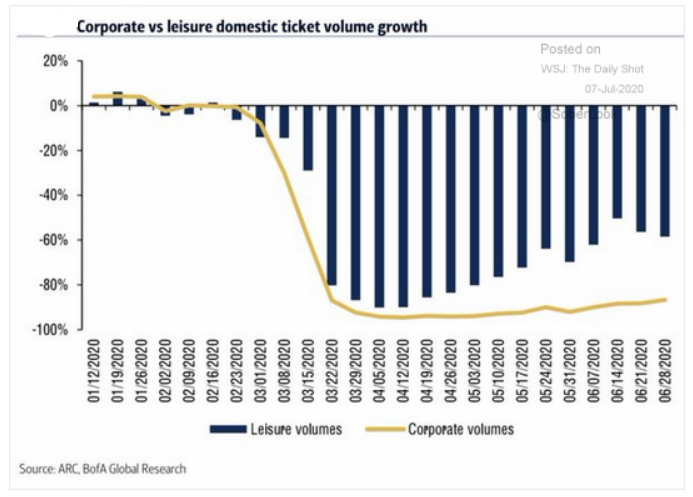

3. Airlines, for instance, have seen little recovery…

Source: WSJ Daily Shot, from 7/7/20

4. Copper continues its own recovery…

Source: WSJ Daily Shot, from 7/7/20

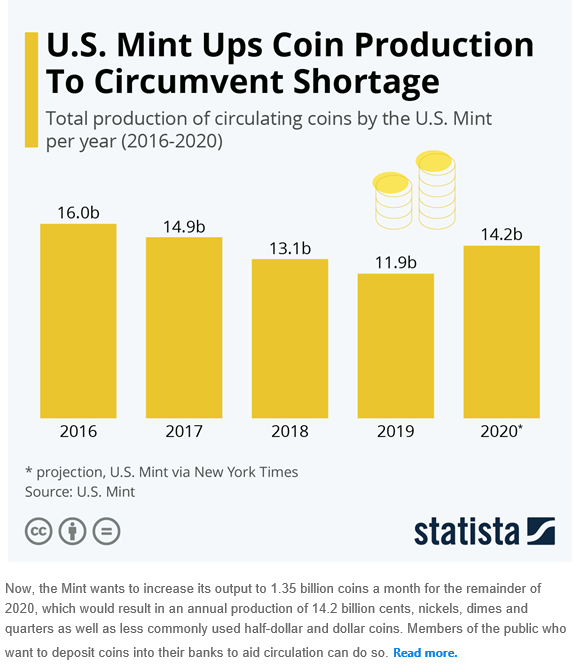

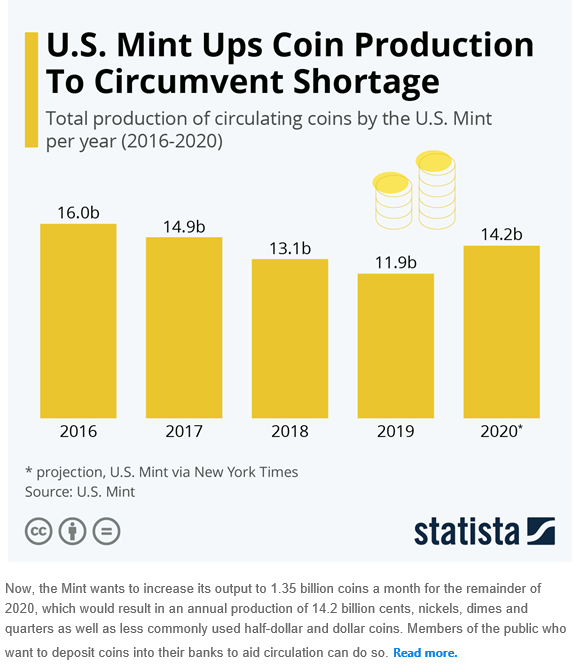

5. This makes no sense to us…who wants to handle change in a pandemic?

Source: WSJ Daily Shot, from 7/7/20

6. Living off a portfolio gets harder and harder…unless there is a massive increase in risk taken…

Source: WSJ Daily Shot, from 7/7/20

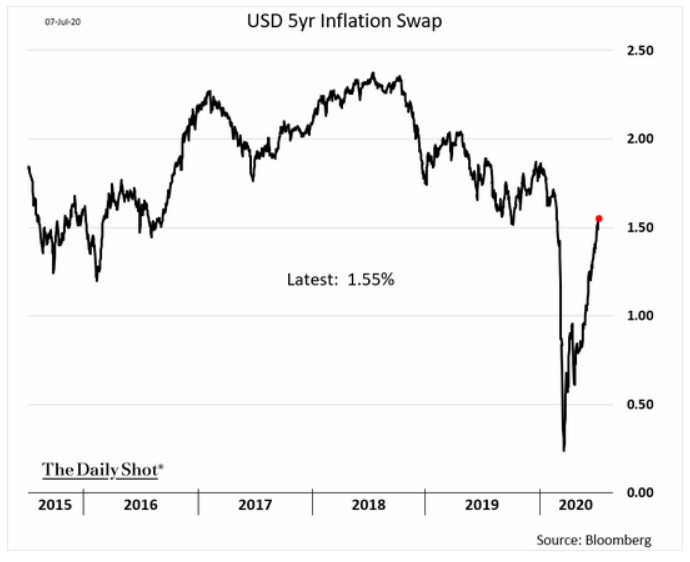

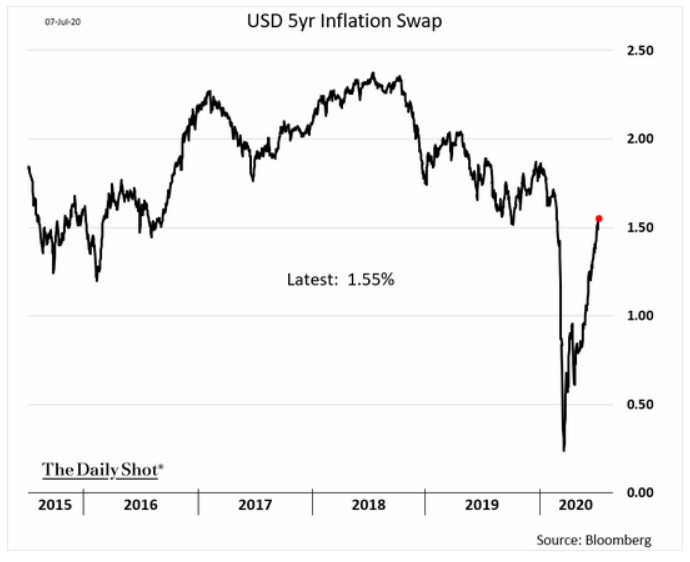

7. Inflation expectations have been quietly rising…

Source: WSJ Daily Shot, from 7/7/20

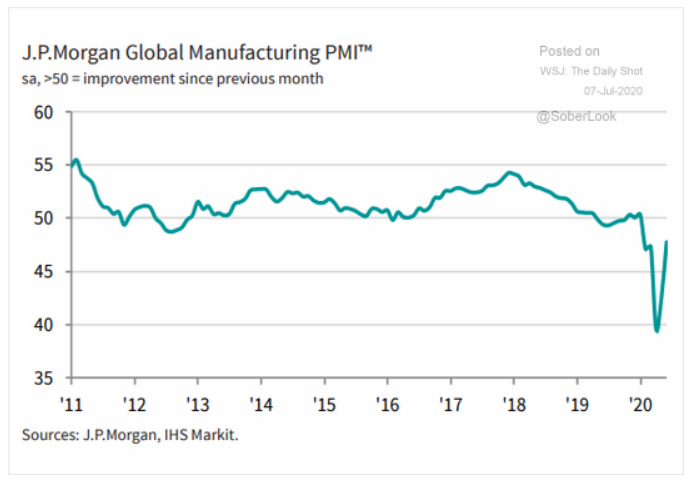

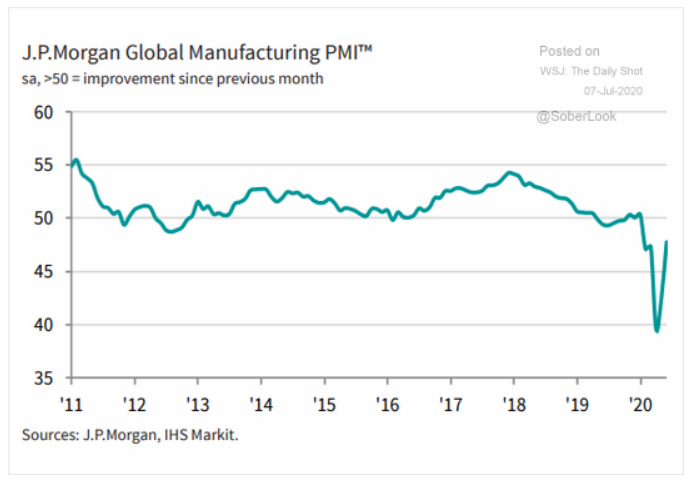

8. Will this recovery continue or lose steam? Opening up international trade will be key.

Source: WSJ Daily Shot, from 7/7/20

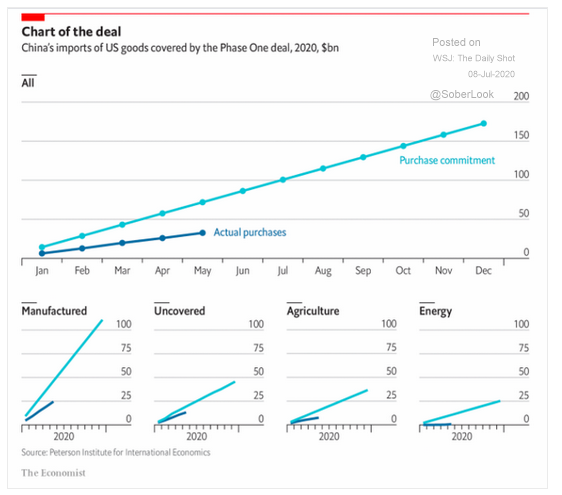

9. Pandemic or not, China has not lived up to its trade deal with the U.S.

Source: WSJ Daily Shot, from 7/7/2

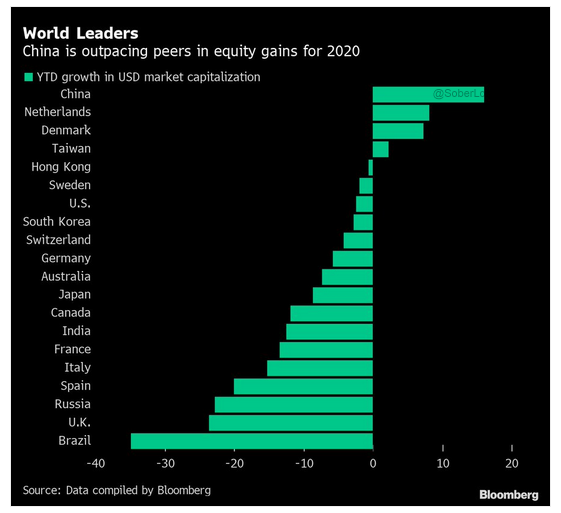

10. Where are the best stock market investment opportunities?

Source: WSJ Daily Shot, from 7/8/20

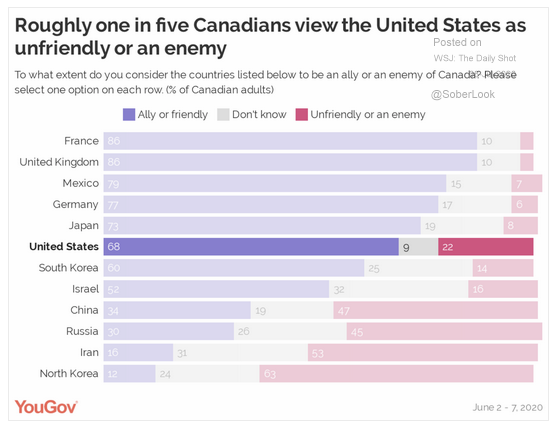

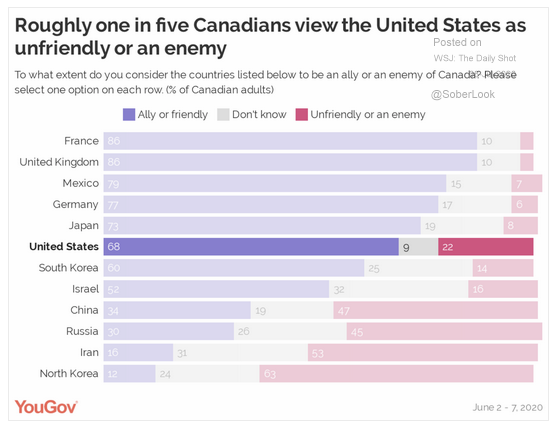

11. How are we viewed by the rest of the world?

Source: WSJ Daily Shot, from 7/8/20