Written by Brendan Ryan

Technology Sector in the “Work from Home” Economy

March 17, 2020 |

Although none of our investment systems directly incorporate fundamental data, we enjoy contemplating the fundamental narratives reflected in the price trends our systems ultimately find attractive. Our systems are currently quite leery of equity or other risk assets, as we now sit firmly in a bear market induced by the widespread economic halt caused by COVID-19. However, our Decathlon system continues to favor technology-sector equities more than its other investment opportunities. In addition, our Weekly Sector Rotation strategies have held on to the technology sector, due to its slightly better momentum, despite selling nearly all other sectors and raising substantial cash.

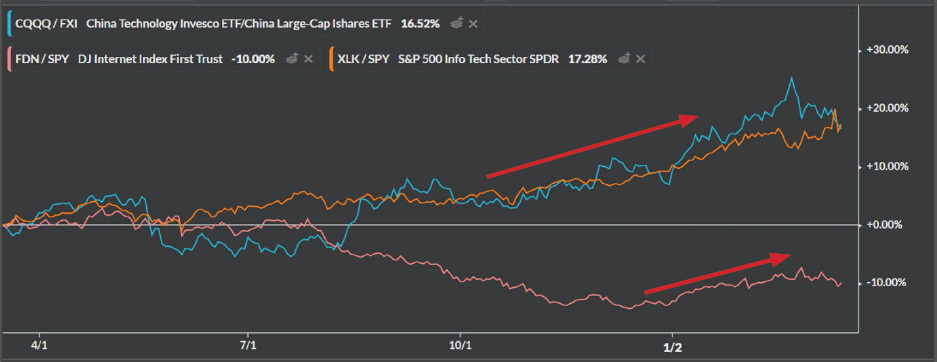

As the chart below shows, if what has happened in China offers a prediction for how the “work from home economy” will play out from here, technology stocks may remain relatively attractive. This seems counterintuitive to how many may have expected the bull market to end. Past bull markets have often been characterized by excess investment in the sectors that led the market on the way up, leading to outsized losses on the way down. The most recent bull market was certainly driven in part by outsized gains from technology companies and the “Internet 2.0” mega-caps, but so far, these same companies are faring than other equities in the bear market that ended the eleven-year bull run.

Source: Koyfin. Data for the period 3/15/2019 through 3/17/2020.

This bear market, likely already a recession, is unique in that the economy seems to lack the “financial excess” that typically brings about the end of an economic cycle. In this exceptional environment there are two obvious reasons why tech companies could remain attractive investments:

- Excellent Balance Sheets

The “FANG” (excluding Netflix which is far smaller) + Microsoft and Apple have cash balances between $55 and $207 billion. “Cash is king,” especially when no one else has any. Companies with weaker balance sheets are likely to be stressed in the current economic environment, while the aforementioned companies should be able to make tough decisions or explore opportunities not available to other businesses. - Countermeasures to Coronavirus Accelerate the Shift from Offline to Online

Consumption is unlikely to stop entirely during social distancing measures, and the long-term secular trend of consuming more online is likely to accelerate, as is the use of software that enables more flexible and efficient working capabilities. While the advertisers–from which some of these giant technology companies draw large portions of their revenues–will surely pull back spending significantly, it is unlikely the usage by their user bases will falter. In fact, the “forced” introduction of work-from-home arrangements may actually take hold at some companies, which would more permanently increase cloud and/or online activity.

Although there is minimal financial guidance coming from companies in the midst of this crisis, some anecdotes seem to support the idea that the “winners” of our economic expansion may continue to “win” on a relative basis in this bear market.

- JD.com, the largest online and largest overall retailer in China, expected double digit sales growth for the first quarter as recently as a month ago, despite China recently releasing -4% retail sales growth for February.

- Walmart’s CEO seemed to corroborate that as well:

“I mean customer behavior can change in a period of time like this. I think we saw that some in China as people bought more online and we were able to satisfy some of that demand there.”¹– Walmart (WMT) CFO Brett Biggs

- Management at Adobe and Zoom have offered similar sentiment on the shift to digital in the wake of the new “work from home” economy.

“This if anything will accentuate the need to engage digitally not just internal to the corporation to keep the corporation going, but externally, in order to engage with customers.”²

– Adobe (ADBE) CEO Shantanu Narayen“Given this coronavirus, I think the over the night [sic] almost everybody read and understand [sic], they needed a tool like this. This will dramatically change the landscape.”³

– Zoom (ZM) CEO Eric

It is easy to instinctually want to “sell everything” during such levels of unprecedented market volatility. We feel most at ease following the guidance of our quantitative models rather than our own emotions, and the most successful investors during this period will keep a level head and invest with reason. This may be one example of an area where things are not necessarily as dark as they are in other corners of the economy. Of course, no one knows what the future will bring, and we stand ready to heed our models’ guidance should it change as the economic situation unfolds.

Sources and Disclosures:

1,2,3 The Transcript, “The Transcript 03.09.20”, 03/09/2020. https://theweeklytranscript.com/2020/03/09/the-transcript-03-09-20/

Copyright © 2020 Beaumont Capital Management (BCM). All rights reserved.

The views and opinions expressed throughout this presentation are those of the author as of March 17, 2020. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person.

The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector investments concentrate in a particular industry, and the investments’ performance could depend heavily on the performance of that industry and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Past performance is no guarantee of future results. ETF performance shown is gross of fees and expenses. An investment cannot be made directly in an index.

All BCM strategies invest solely in long-only ETFs.

The BCM Decathlon strategies are predictive, algorithm driven and use pattern recognition technology (PRT) to rank a population of ~110 handpicked ETFs in which it will “invest” in the 10 most promising based on upward price movement and defined volatility levels. The portfolio manager maintains full discretion over the portfolio.

Popular Posts

- Financial Sector Breakout, Record Setting Trade Deficits, Underwhelming Regional Fed Reports

- BCM 3Q19 Market Commentary: Blinking Yellow Lights

- BCM 2Q20 Market Commentary: The Best of Times and The Worst of Times…

- Unemployment Plateaus, Good News for Banks, and a Look at Post-Recession EPS Recoveries

- Unemployment Climbs, Strong Recoveries from Retail & Manufacturing, and Trouble for High Yield